Financial Services Institutions

We know corporate treasury. You know financial services. We partner with you to help you serve and support your corporate clients. Explore Our ServicesContact A ConsultantService Offerings

Pricing Analysis

Learn More...

Banks invest heavily in product development, security and controls, and relationship management in order to provide the best experiences for their customers. In a budget focused market, however, competitive pricing remains a key corporate driver in bank selection, so banks must maintain vigilance around their pricing models to keep their edge.

Bank Staff Training

Learn More...

You hire great people who are great at sales. Most, however, have gaps in their knowledge about cash management and treasury, restricting their success. Our training courses are designed to be effective, engaging, and targeted. Your staff will understand and apply their training, and you’ll see the results in their client interactions.

Are your sales and relationship management staff the most trusted advisors of your top clients? You’d love to know that when your clients reach an impasse or need help, the first call is to your team, every time. How can you hope to reach that level of trust with a client when most of your team is only focused on the bank’s products and solutions?

Your sales officers must hire representatives who need a thorough understanding of what really drives your corporate and commercial treasury clients. Your key clients and prospects are very busy. Your bank probably extends them credit, so your sales team can usually get an audience out of their sense of obligation. This only provides a very limited window, and making that time count is top priority—moving the meeting from ‘obligation’ to engagement. Through excellent and unique training, you can empower your sales team with techniques to learn your treasury clients’ goals and identify what stands in their way. They will present meaningful solutions to clients, or at least have an educated conversation—the first step down a path to a solution and a deeper relationship.

A meaningful sales process will move you from the banker who pops in every few months to a trusted advisor. Strategic Treasurer’s senior consultants provide a unique, two-track training system to help you develop this process. As former practitioners, bankers, and consultants, they offer unique insights that only a 360º perspective can afford. How are you going to reach your aggressive new goals each year?

Time-to-Revenue

Learn More...

Sometimes your team makes a sale, but it seems like the implementation never starts, and therefore the expected revenue never materializes. Strategic Treasurer can work on your client’s behalf to get a stagnant process moving.

Your client onboarding group is ready to help and does help in any and every way they can. However, the client has other obligations, numerous activities, and ample distractions. Dates keep slipping and goals are not met although reasons are given. Too much time is spent chasing, chasing, and chasing…

In other instances, the implementation process may begin, but the services are under-implemented, left at only 50–75% of the expected level. The client declares a project to be complete when it is only partially implemented. The client is exhausted and has three other fires and two other projects that need work as well. This delays the project and lowers their satisfaction level.

As a result of all these delays, your team experiences loss across many spectrums—less revenue than was expected comes in; revenue is also lost as dates continue to slip and resources are required to pour more of their time into the project. All this adds up to an overall loss of profit for the bank.

Our team of experienced onboarders and implementers can help. We can meet with your client and help to establish a reasonable plan, distributing the work that needs to be accomplished on the client side between their team and ours. Oftentimes, with a little bit of background information, our team can complete many tasks and get things moving rapidly. You’ll quickly find your time to revenue decreased when partnering with our team.

Partnership Opportunities

Webinars

Strategic Treasurer hosts multiple webinar presentations annually, each addressing key areas of compliance, finance, or treasury. Webinars provide attendees with up-to-date, accurate information on the addressed topic, as well as key findings from surveys, analyst reports, and projects. Typically, webinars are co-hosted by solutions providers, who are able to provide additional insight and content from an alternate viewpoint. Webinars also provide the opportunity for attendees to earn free CTP credits.

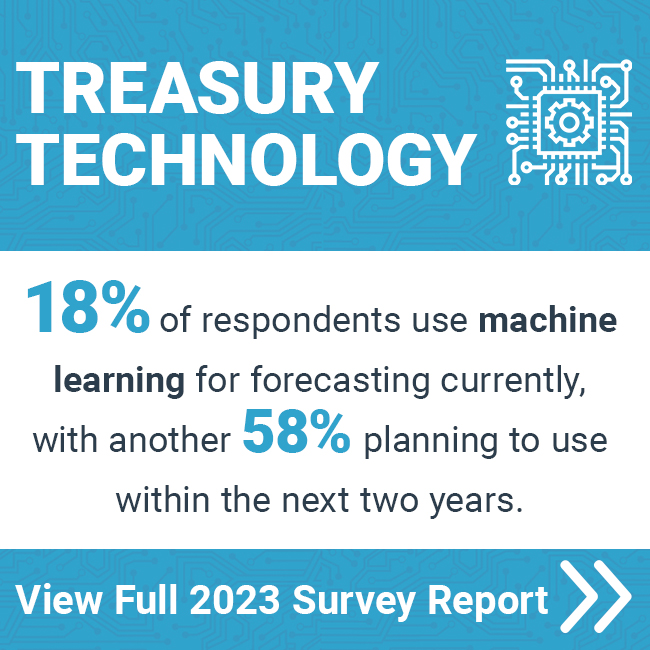

Surveys

Strategic Treasurer provides quality primary market research through our annual surveys. These surveys are distributed for participation to our active contacts—all treasury and finance professionals. The results are calibrated and released in our survey results reports and webinars. This research provides a solid foundation from which we can advise. Practitioners are able to see how their firms align in comparison to others, which can be helpful in determining if your organization is on track, ahead of the curve, or lagging in a particular area.

Podcast

Webinar: Understanding Payment Formats | May 14

While not an inherently thrilling topic for most, the foundational aspects of payment formats have become an area of high interest out of necessity. Particularly given the many new payment types and rails coupled with the reality of obsolescence as formats move off of support, treasury professionals are finding themselves in need of a clear understanding of the many format types, their differences, their trajectories, and how each element matters.

This webinar will cover many of the key elements of payment formats, including both the older style (MT101, Fedwire, ACH) as well as newer payment formats (XML-ISO20022/pain.001, API). The information in this session is targeted to hit the relevant level of detail for treasury staff. The webinar will be fast-paced, practical, and applicable for the director/AT/treasurer levels, in addition to analysts and treasury managers.

Webinar: Exclusive Research Results: Generative AI in Treasury and Finance | May 1

The Generative AI in Treasury and Finance Survey probed corporate and provider respondents on their awareness, use, and planned use of artificial intelligence (AI) and generative AI. The results of this timely research show particularly high interest in using AI to improve cash forecasting, significant plans for expanding AI use in the coming year, and much more. This session will cover key highlights from the results and equip treasury and finance with an understanding of the industry’s overall expectations and current actions with regards to these rapidly developing technologies.

Webinar: Short-Term Investing Part 3: Fed Meeting Analysis and Impact | May 2

This fast-paced webinar will review the key statements and outcomes of the FOMC meeting from the prior day. The panelists will also discuss trends in the economy and the liquidity market. This discussion will cover investor portfolios, the role money market funds are playing in these portfolios, and their features compared to deposit products and direct securities.

Webinar: Relentless Fraud: Addressing the Continual Attempts | April 25

Fraud attacks and attempts have been automated, sophisticated, and relentless. New methods of attack and variations continue to emerge. Learn in detail about growing and emerging threats – including some surprising uses of technology – and discover how organizations are addressing their defenses with structure, services, training, and focus.

Webinar: How to Never Worry About FBAR Again | April 4

The Report of Foreign Bank and Financial Accounts (FBAR) is now a well-established compliance reporting requirement for many corporations and their signers. For most, compliance activities are a headache of sorts. They require care and focus but can feel like a distraction. For some companies, treasury handles all or some of the process, while tax takes the lead for others. Surprisingly, there are still far too many misconceptions about what is required.

This session will explore the key requirements of FBAR and the core elements of the process that must be completed. When would a company manage the entire process internally? When does it make sense to get assistance? Knowing what a proper process looks like in the context of the annual calendar can provide helpful structure for those who don’t find compliance to be their burning passion at work. This webinar is aimed at helping you eliminate the worry of FBAR.

Webinar: Simplifying the Complexity of Inbound Cross-Border Payments | March 28

Expanding sales globally comes with many upsides but also with significant challenges. Managing how payments are collected in numerous countries is an issue for even the largest companies. For others, this has been a nearly insurmountable challenge. This session will cover various complexities of managing inbound payments: countries, banking considerations, compliance requirements, and friction for your customers. Methods of reducing this complexity will be explored from multiple views, including operational efficiency, liquidity management, cost, and client impact.