Moving Beyond Tech to Improve Working Capital

As any seasoned treasurer knows, the effective management of working capital and liquidity is a vitally important function within an organization and one of the core responsibilities of treasury. With hundreds or potentially thousands of transactions, transfers, and money movements taking place every day, the task of maintaining visibility to cash and forecasting cash flows requires careful oversight and accurate planning. For this reason, cash positioning and cash forecasting tools are the two most needed functionalities for treasurers.*

However, an effective working capital management (WCM) strategy requires more than just the right set of tools; it requires constant communication and collaboration with the various departments whose operations have a direct impact on liquidity levels. That is, while treasury is charged with managing working capital, they are not the only department with a stake in it. Rather, there are a number of departments, including AP, procurement, finance, and sales, whose actions can substantially increase or reduce working capital. Thus, for any WCM strategy implemented by treasury to be successful, there must be buy-in from each of these departments for two main reasons:

1. Avoiding Pushback: Failing to consult each effected department before implementing a new working capital strategy can negatively impact the attitudes of these departments and limit their motivation to participate or follow through on any changes, especially if the new strategy requires a large shift in how they operate.

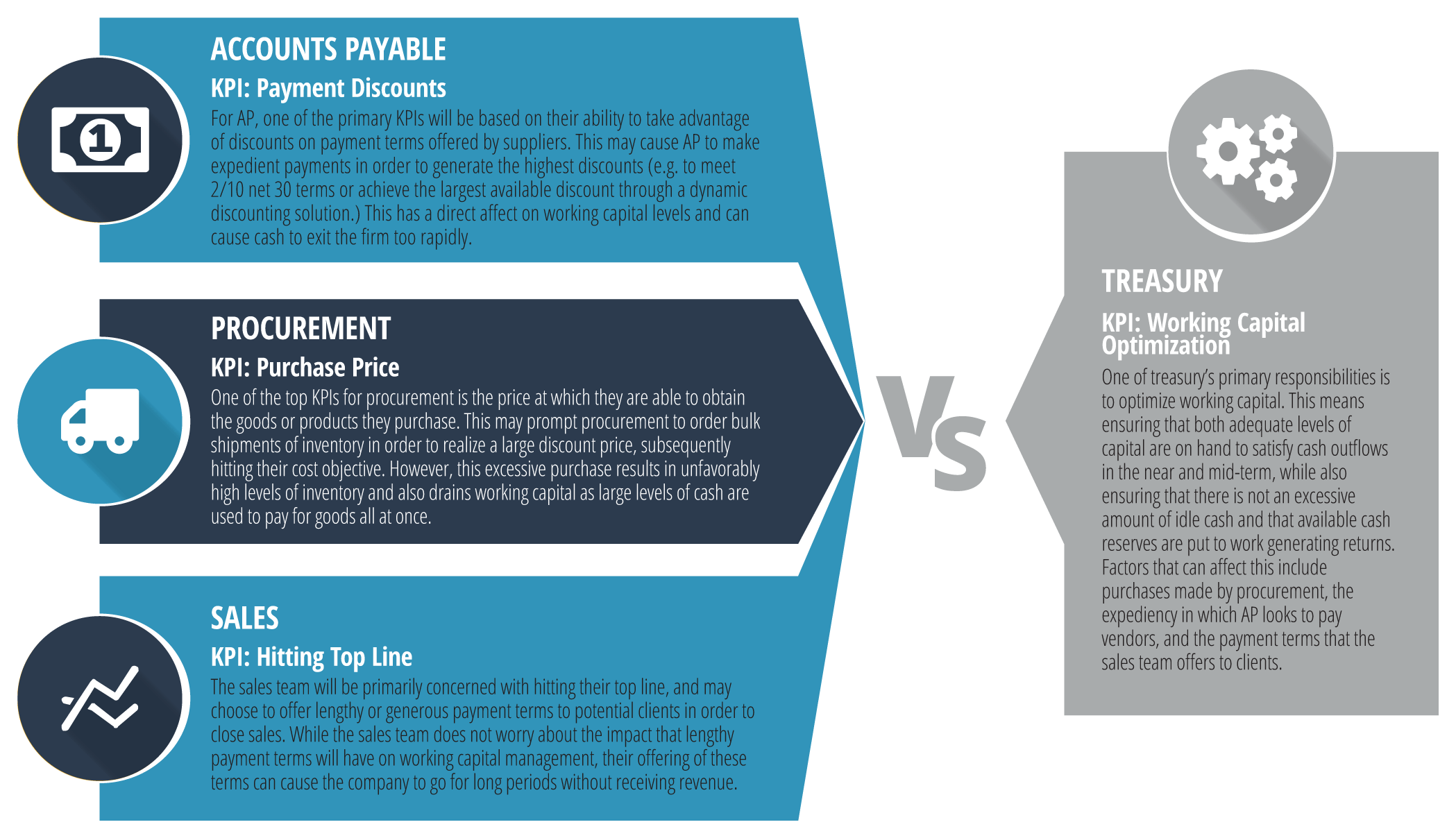

2. Eliminating Competing KPIs: Each department has their own set of key performance indicator’s (KPIs) and objectives. These KPIs do not always align with one another, and in some cases directly conflict with the objectives of the organization at large. Failing to eliminate these competing KPIs can result in major obstacles that severely impact the success of any WCM strategy.

Another similar management strategy that is gaining traction in the corporate world is the Objectives and Key Results (OKR) framework. With this in mind, it can be tempting to ask “should your business use OKR or KPI?”. Ultimately, the choice is yours to make, and will depend on a multitude of factors, so be sure to do as much research as possible before you commit to a decision.

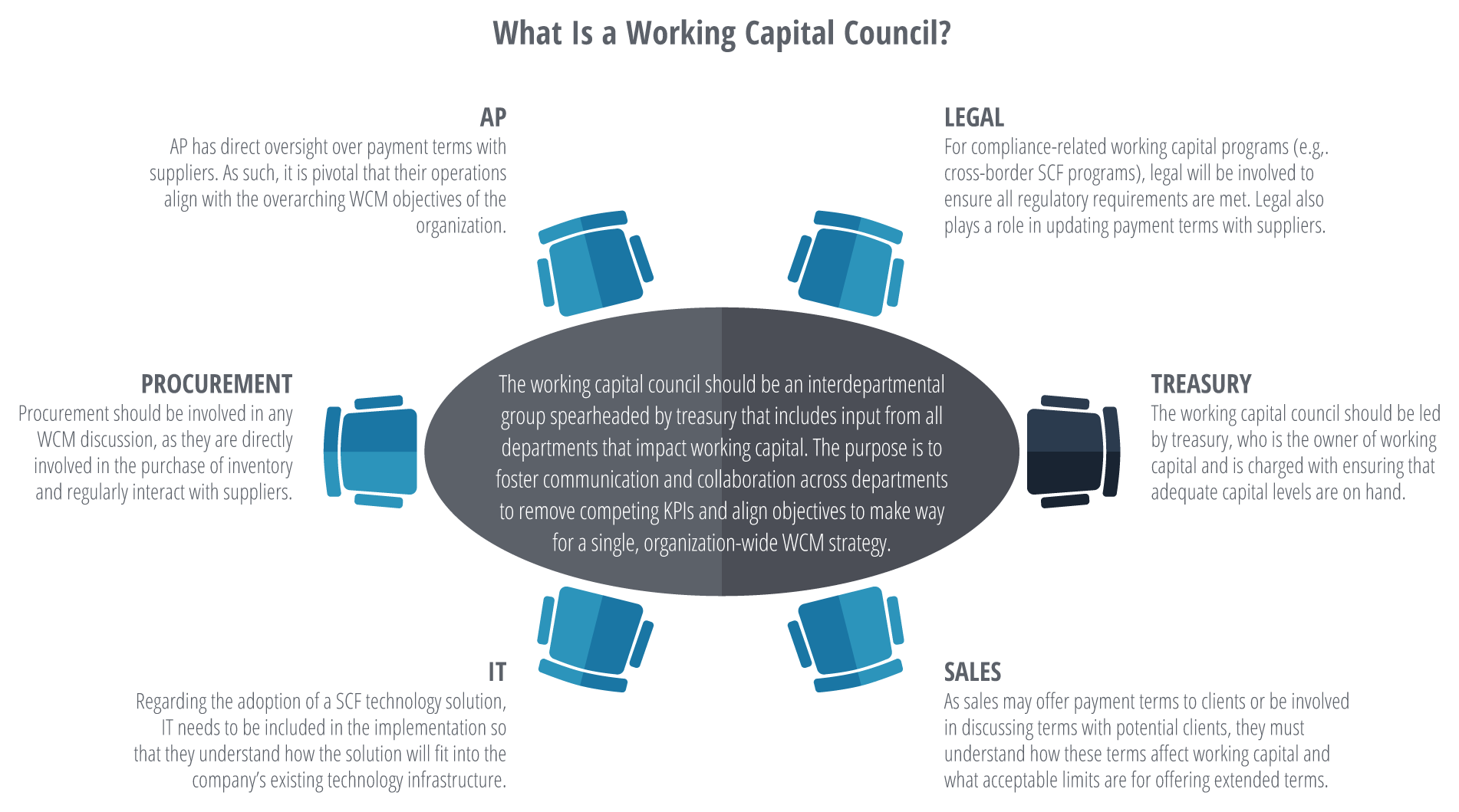

What is a Working Capital Council?

A working capital council is a committee spearheaded by treasury that consists of representatives from all the departments with a stake in working capital, such as treasury, finance, accounting, procurement, sales, and AP. As any changes to a firm’s WCM strategy are being considered, treasury notifies the representatives and sets up a meeting between them to discuss the potential impact that the changes will have. Each department can ask questions about the new strategy and also share their views on how it will impact their operations. This discussion can also serve as an opportunity for any competing KPIs that exist between specific departments to be eliminated and replaced with a set of more collaborative KPIs that address the needs of the firm as a whole.

The working capital council also gives treasury the opportunity to explain why they feel a new WCM strategy is necessary and what the benefits will be for the firm should the changes be implemented. In this way, treasury ensures that each department has had a chance to analyze the proposed changes and discuss what their impact will be. This goes a long way in promoting an environment of trust and cooperation internally, and lessens the skepticism/resentment against treasury as they make changes.

Case in Point

Suppose that treasury wants to implement a new WCM strategy that calls for the extension of days payable outstanding (DPO) with suppliers by an additional 15-20 days. Treasury sees this strategy as allowing the firm to redirect cash flows towards other projects, which will benefit the firm in the long run. However, this action means that AP must adjust their payment terms with vendors, which will ultimately affect their relationship. At the time, AP is providing early payment to suppliers to obtain discounts on the purchase price.

Now, suppose that treasury did a poor job in explaining to AP the overall benefits that this new WCM strategy will have and why the changes are necessary. As a result, AP does not see any upside to this new strategy, and instead views the changes as detrimental to their objectives and damaging to the relationships they have with suppliers. This can cause resentment towards treasury, both for making large changes without consulting other departments and for not properly communicating the changes even after a new strategy had been decided upon. Subsequently, AP may not take the changes all that seriously or may even outright resist them.

Departmental Conflict

To see how departmental KPIs could cause internal conflict, consider how the objectives of three specific departments, AP, procurement, and sales, effect treasury’s ability to manage working capital. For AP, departmental emphasis may center around taking advantage of discounts offered by vendors in exchange for early payments. This would motivate AP to pay suppliers early and reduce their DPO, which would also result in cash leaving the company quicker than normally would be the case.

At the same time, sales’ primary objective will be hitting their top line. In order to win over clients, they may offer lenient payment terms that don’t call for payment until several months down the road. Subsequently, incoming cash flows take a hit as the organization must wait longer to get paid. Thirdly, a top KPI for procurement will be the price at which they can obtain goods or materials. This may prompt them to order bulk shipments of inventory to realize a large discount, thus hitting their price objective but also tying up excessive levels of cash.

Although each department in this scenario has the best interests of the company in mind, their individual KPIs and drivers are in conflict with one another and are causing a severe drain on working capital. Thus, as treasury seeks to manage working capital, the actions, objectives, and drivers of these departments must be taken into consideration. If any WCM strategy is to be successful, the competing KPIs of each department must be replaced with a single set of working capital metrics. To do this, treasury must work to create an environment where communication between departments is encouraged. This is where working capital councils are so effective, as they provide a setting where interdepartmental collaboration and negotiation can take place.

Current Corporate Practices

Overall, the use of working capital councils in the corporate realm is seeing strong growth. In a recent global survey**, respondents were polled over the existence of a working capital council at their firm. Results found that 17% of firms were currently using a working capital council, with an additional 8% looking to form one within the next two years. This would make for 1 in every 4 firms having a working capital council in place by 2019.

For some firms, the idea of a working capital council may be strange or even a bit taboo. For treasurers that have traditionally exercised full control over working capital, the idea of allowing input from multiple departments can seem like a daunting task, and one that would complicate rather than simplify any WCM strategy. However, the benefits that working capital councils provide are crucial for firms looking to take their WCM strategies to the next level. If you want your working capital program to be successful, you must have buy-in from other departments. And if your relationship with those departments is strained, the success of your program will certainly be impacted.

Footnotes:

* Strategic Treasurer. “Rapid Research: Technology Use.” Survey. StrategicTreasurer.com. 2016.

** Strategic Treasurer, Bottomline Technologies, & Bank of America Merrill Lynch. “B2B Payments & WCM Strategies.” Survey. StrategicTreasurer.com. 2017.

Isaac Zaubi

Publications Manager, Treasury Analyst

Isaac Zaubi has been with Strategic Treasurer for over 2 years as a treasury analyst before coming into his current role as Publications Manager. Isaac’s contributions center primarily around the development and management of publications, including fintech analyst reports, survey results reports, e-books, and whitepapers.