Treasury Technology Analyst Report

Treasury's go-to source for insights into the latest developments, trends, and solutions for over nine years. Download ReportSupply Chain Finance & Cash Conversion Cycle Solutions

Enterprise Liquidity Management

Access Your Definitive Guide to Treasury Technology.

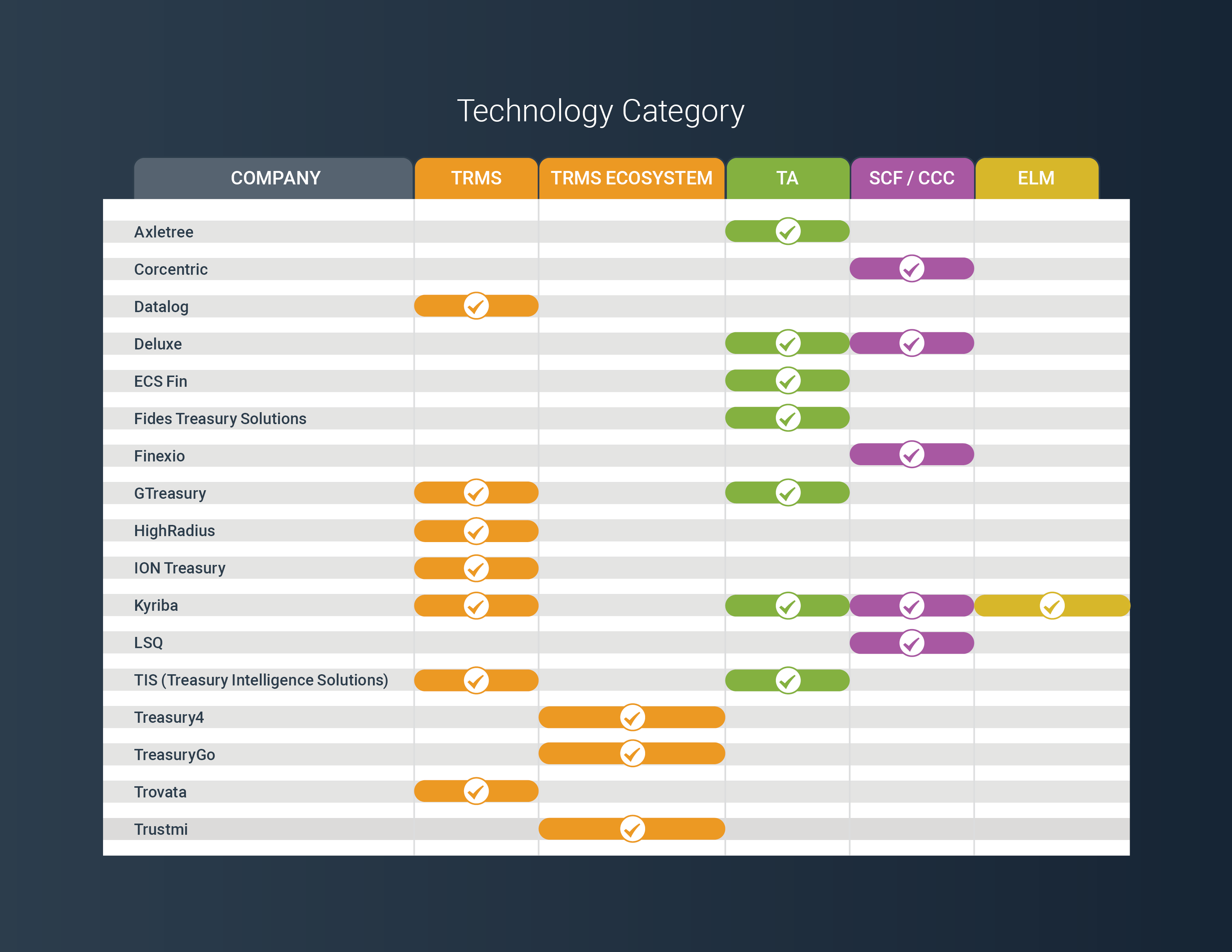

Researching new treasury and finance technology can be overwhelming. Strategic Treasurer has stepped in to help. Explore our definitive guide to the treasury technology landscape and discover detailed, data-based coverage of:

- Treasury & Risk Management Systems

- Treasury Aggregators

- Supply Chain Finance & Cash Conversion Cycle Solutions

- Enterprise Liquidity Management

Learn more about these technologies and evaluate some of the top vendors in each industry.

Treasury and Risk Management Systems (TMS)

Designed to function as the core piece of technology serving treasury’s specific needs and integrating smoothly with other tech types, the TMS aims to solve treasury’s cash management troubles, coming into use when Excel is no longer enough to support the department’s cash positioning, visibility, and forecasting needs. This section of the Analyst Report covers the role of a TMS in the modern treasury’s technology stack, the pain points these solutions address, factors impacting their adoption, and leading practices for successful selection and implementation.

Treasury Aggregators (TA)

The connectivity specialists of the treasury tech space, aggregators pull bank data in, send payments out, and handle all the internal and external connections necessary to perform those actions. TAs are designed for the treasury departments whose payment activity is complex and/or high-volume, helping solve pain points around manual data aggregation, disparate payment processes, and numerous file formats. This section of the Analyst Report explains the role of a TA, covers the complexities that might indicate the need for one, and discusses the future of aggregation and leading practices for implementation.

Supply Chain Finance (SCF) & Cash Conversion Cycle (CCC) Solutions

This section covers a wide range of solutions that can help with working capital management by impacting processes related to buyer-supplier liquidity, order-to-collect, and procure-to-pay. SCF aims at helping companies whose supply chain relationships are vital and who require some level of flexibility in their payment terms or capital deployment. CCC solutions are suited for companies with bottlenecks or defect-prone processes in their CCC. This section of the report covers reverse factoring, dynamic discounting, and hybrid SCF solutions, discusses in summary fashion the range of CCC automation solutions, and delves into factors impacting these solutions and the steps necessary to implement any working capital initiative.

Enterprise Liquidity Management (ELM)

A newer category, ELM systems offer a comprehensive view of liquidity across the organization. These robust solutions include the base functionality of a TMS, but with far more extensive reach. ELM systems are built to integrate information from across the company, allowing treasury to view and manage liquidity on a comprehensive scale. This section describes the ELM category, placing it in the context of other enterprise-level systems and of TMSs, and discusses the technological advances and fundamental shifts running in parallel with its emergence.

Download your complimentary report

Upon submission, you will be sent an email confirmation with the link to download the report. If you encounter any issues or have any questions, please don’t hesitate to reach out to our team.