Tech Tune-Up: Five Areas of Innovation that Treasurers are Focusing on in 2018

This article was originally posted in the Treasury Update Newsletter (Quarter 1, Spring 2018). You can see the full newsletter here.

Treasury’s Perspectives

Since the beginning of the 21st century, there has been a continuous wave of innovation transforming the financial environment. From the development of cloud-based TMS solutions over a decade ago to the more recent introduction of blockchain and distributed ledger technology (DLT), the technology tools available to treasurers have undergone significant progression in a relatively short time frame. But out of all these innovations, what are the areas that practitioners are focusing on the most? What improvements are they taking notice of, and are there any areas where additional improvement is still needed? Results from a recent survey conducted by Strategic Treasurer and TD Bank have shed light on exactly how treasurers are viewing today’s financial technology landscape, and pinpoints where their investment and focus will be directed in the years to come.

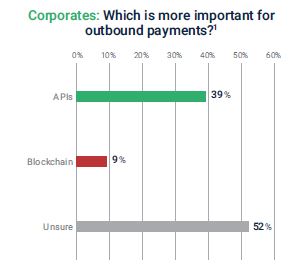

APIs Far More Important Than Blockchain on Outbound Payments

In the past several years, we have seen blockchain erupt in popularity, particularly due to the prominence of cryptocurrencies  like bitcoin and the development of payment networks such as Ripple. But when it comes to the short-term impact of APIs and blockchain on payment operations, over four times as many corporates and six times as many banks see APIs playing a larger role. While a significant portion (52%) of corporate respondents were unsure as to which was more important, 39% selected APIs, while only 9% chose blockchain. On the banking side, 66% chose APIs and 11% blockchain, while 24% were unsure.

like bitcoin and the development of payment networks such as Ripple. But when it comes to the short-term impact of APIs and blockchain on payment operations, over four times as many corporates and six times as many banks see APIs playing a larger role. While a significant portion (52%) of corporate respondents were unsure as to which was more important, 39% selected APIs, while only 9% chose blockchain. On the banking side, 66% chose APIs and 11% blockchain, while 24% were unsure.

When it comes to the short-term impact of APIs and blockchain on payment operations, over four times as many coprorates and six times as many banks see APIs playing a larger role.

This preference for APIs over blockchain could have several causes. However, perhaps the most notable development in recent times involves the introduction of the Revised Payment Services Directive (PSD2) and the creation of an “open banking” environment. APIs play a big part in streamlining integration between bank systems and those of corporates and other fintechs/third-parties. APIs are already a component of many financial solutions, and given the impact of PSD2, the case for APIs is strong. Moving forward, APIs look to play an ever-increasing role in facilitating straight-through processing (STP) between systems and helping to reduce manual workflows for information reporting/processing. On the other hand, blockchain, while no doubt an important and significant innovation, has not yet risen to the top of treasury’s technology priorities. In the years to come, we will be closely monitoring for any shift in corporate treasury’s stance regarding either of these technologies.

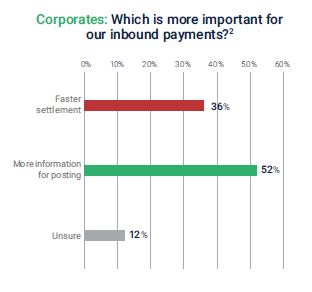

Faster Settlement? Nice, But How About Enriched Messaging

When it comes to payments, the pace of development we have witnessed over the past several years with regards to speed of settlement has been dramatic. While standard ACH rails can deliver domestic payments with next-day settlement, the use of

Same-day ACH or RTP in the United States can settle funds in a matter of hours; sometimes within minutes or mere seconds  of execution. The same is true with Bacs in the UK and via a number of other domestic clearinghouses worldwide. RTGS systems and wires, while often more expensive, can also provide real-time settlement of funds for both domestic and cross-border payments. But despite rapid improvements in the realm of speed, there has been less headway in the funds transfer arena regarding the enrichment of payment information, advices, and remittances.

of execution. The same is true with Bacs in the UK and via a number of other domestic clearinghouses worldwide. RTGS systems and wires, while often more expensive, can also provide real-time settlement of funds for both domestic and cross-border payments. But despite rapid improvements in the realm of speed, there has been less headway in the funds transfer arena regarding the enrichment of payment information, advices, and remittances.

Despite rapid improvements in the realm of payments regarding faster settlement, there has been less headway regarding the enrichment of payment messaging and information.

As it stands today, many of the text fields and remittance options available via ACH, bank proprietary formats, etc., are limited, with only a handful of characters allowed for each message. While the introduction of XML-based messaging and ISO 20022 formats have helped, these standards have not been adopted everywhere, and many businesses continue to operate without their use. As many of the transfers treasury executes involve the payment of multiple invoices or contain detailed instructions, these limited remittance fields are insufficient and can cause confusion for the recipient and result in further processing delays or errors. This is definitely an area in need of further improvement and we expect to see significant development along this front over the next three to five years.

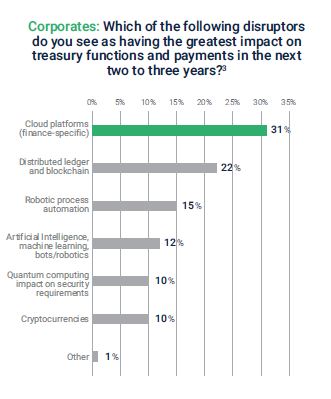

Cloud Solutions at the Center of Treasury’s Technology Focus

Although treasury continues to indicate that their levels of technology investment and spend will be elevated during the 2018  calendar year, their focus is not necessarily on the newest or “emerging” tech. Instead, the one technology that most corporate practitioners see as having the most significant impact on treasury functions and operations over the next two to three years is cloud-based (SaaS) solutions.

calendar year, their focus is not necessarily on the newest or “emerging” tech. Instead, the one technology that most corporate practitioners see as having the most significant impact on treasury functions and operations over the next two to three years is cloud-based (SaaS) solutions.

Corporate practitioners see cloud-based (SaaS) solutions as having a more significant impact on treasury functions and operations over the next two to three years than blockchain, AI, or cryptocurrencies.

Although cloud-based solutions have been around for some time, their use has continued to see steady adoption year-over-year. As it stands today, the TMS market is dominated by SaaS products and the vast majority of new sales are of cloud-based solutions. A SaaS-based TMS solution can act as the hub of a treasurer’s daily activity and drive their operations across each area of responsibility, including payments, cash positioning, and risk management. Given the sophistication of today’s SaaS applications and the broad suite of capabilities they offer, treasury clearly feels as though the current impact of these solutions is more important than developments along the AI and blockchain front, at least for the time being.

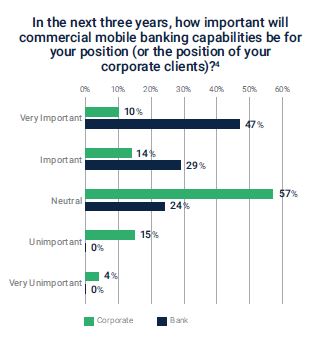

Despite Banking Enthusiasm, Corporates Response to Mobile Banking is Subdued.

When banks were asked how important they considered commercial mobile banking applications would be for their  corporate clients over the next two to three years, 76% found such apps as important or extremely important, and not a single bank respondent saw them as being unimportant. Given these percentages, banks are clearly anticipating high levels of development and growth in the commercial mobile banking sector. However, ask a corporate how important such mobile applications are for their operations and the response is quite different. In fact, just 24% of corporate respondents saw such developments as important and only a slightly smaller portion (19%) saw them as unimportant. The majority, 57%, were neutral.

corporate clients over the next two to three years, 76% found such apps as important or extremely important, and not a single bank respondent saw them as being unimportant. Given these percentages, banks are clearly anticipating high levels of development and growth in the commercial mobile banking sector. However, ask a corporate how important such mobile applications are for their operations and the response is quite different. In fact, just 24% of corporate respondents saw such developments as important and only a slightly smaller portion (19%) saw them as unimportant. The majority, 57%, were neutral.

In analyzing recent industry data, there is one primary factor that could be the cause of this subdued corporate response. In a 2017 Strategic Treasurer survey*, a greater number of corporates indicated they were uncomfortable with using mobile apps for B2B payments than those that were comfortable. When it comes to mobile devices, corporates have consistently shown that security is a major concern, and many are reluctant to introduce potential fraud exposures to their payment and banking operations. The good news here is that 32% of corporates indicated their comfortability with mobile payments has increased over the past year, compared to just 3% whose comfortability had decreased. Adoption in the corporate environment always takes time.

Despite bank enthusiasm for commercial mobile banking applications, corporate treasury’s response to such developments has been subdued.

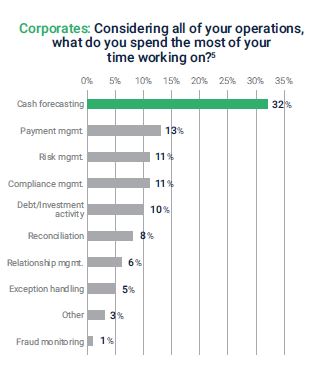

Forecasting: Still a Thorn in the Side of Treasury

While the fundamentals of cash forecasting are complicated enough, results from a recent survey found that practitioners struggled more frequently with the forecasting modules of their TMS than any other area. In fact, 21%** of those who purchased forecasting functionality as part of their TMS indicated that they were no longer using it because it was inefficient or did not function properly. And with results from the Treasury Perspectives survey finding that 31% of treasurers spend more time on forecasting than any other area of responsibility, this is clearly an area where corporates could do without any  added inefficiencies.

added inefficiencies.

Nearly one-third of corporate practitioners spend more time on cash forecasting than any other area of operation.

In order to solve this dilemma, it may be time for those treasurers that continue to struggle with cash forecasting to take a look at what the most updated forecasting solutions are capable of. With a number of Fintech firms continuing to push the boundaries of what forecasting solutions can accomplish, the tools available to treasury in this area have clearly evolved beyond the use of spreadsheets and other legacy systems. And with 45%* of firms indicating an increased importance on cash forecasting over the next year, the need for practitioners to identify solutions that can aid in facilitating accurate and timely cash forecasts is now more important than ever.

Footnotes:

Graphs 1-5: Strategic Treasurer & TD Bank Treasury Perspectives Survey. Download the full report here.

* 2017 Strategic Treasurer, Bottomline Technologies, & Bank of America Merrill Lynch B2B Payments & WCM Strategies Survey. Download the full report here.

** 2017 Strategic Treasurer & TreasuryXpress Treasury Technology Use Survey. View the webinar here.

Isaac Zaubi

Publications Manager, Treasury Analyst

Isaac Zaubi has been with Strategic Treasurer for over 2 years as a treasury analyst before coming into his current role as Publications Manager. Isaac’s contributions center primarily around the development and management of publications, including fintech analyst reports, survey results reports, e-books, and whitepapers.