2026 Treasury Technology Analyst Report

Request today!Supply Chain Finance & Cash Conversion Cycle Solutions

Treasury Ecosystems

Access Your Definitive Guide to Treasury Technology.

Researching new treasury and finance technology can be overwhelming. Strategic Treasurer has stepped in to help. Explore our definitive guide to the treasury technology landscape and discover detailed, data-based coverage of:

- Treasury & Risk Management Systems

- Treasury Aggregators

- Supply Chain Finance & Cash Conversion Cycle Solutions

- Treasury Ecosystem

Learn more about these technologies and evaluate some of the top vendors in each industry.

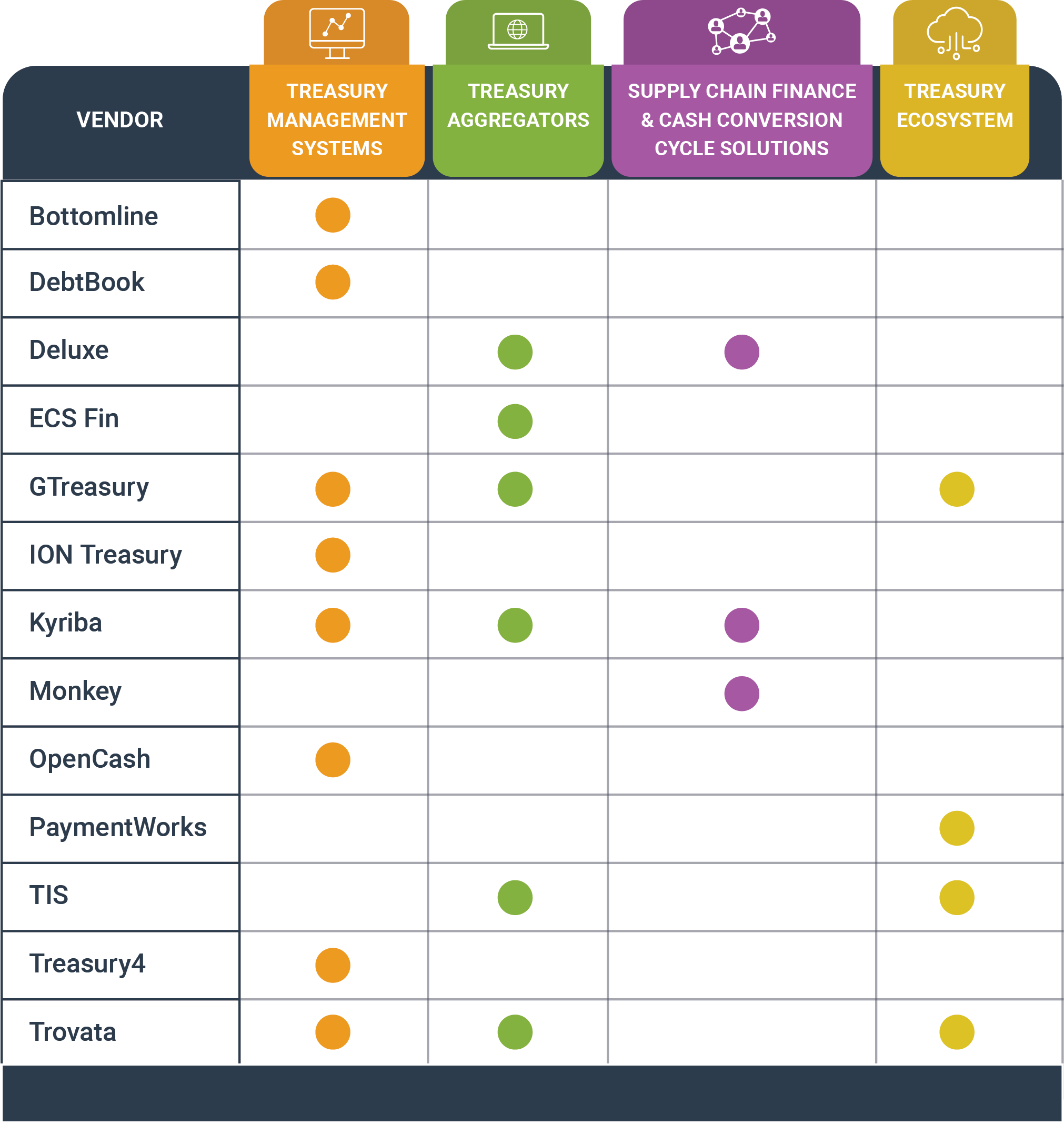

Treasury and Risk Management Systems (TMS)

TMS and TRMS platforms form the operational core for many treasury departments, consolidating key activities like cash positioning, forecasting, payments, accounting, and risk oversight into a single system. Designed to streamline workflows and improve visibility, these systems vary in scale and sophistication, from entry-level solutions for smaller firms to advanced platforms for large, complex enterprises. A well-implemented TMS not only enhances efficiency and control but also serves as a hub that connects with other tools across the treasury ecosystem.

Treasury Aggregators (TA)

Treasury aggregators help organizations manage both payments and bank data through a centralized, standardized interface. On the payments side, they act as payment hubs, routing transactions, converting formats, and ensuring compliance with various bank and regional requirements. On the data side, they collect information from multiple bank accounts and channels and distribute it across internal systems in a usable format. This dual function increases efficiency, supports better decision-making, and enhances control, particularly for organizations operating across numerous banking partners and jurisdictions.

Supply Chain Finance (SCF) & Cash Conversion Cycle (CCC) Solutions

SCF and CCC tools support working capital optimization by improving the timing and efficiency of cash flows. SCF platforms help buyers to either leverage excess capital or third-party financing to support both internal needs and supplier resilience. CCC solutions automate and streamline areas like invoicing, collections, and reconciliation across the cash conversion cycle. While often managed by other teams, these solutions directly impact liquidity and are increasingly relevant to treasury’s strategic objectives.

Treasury Ecosystem Solutions

Beyond core platforms, a growing number of specialized solutions address targeted needs across the treasury landscape. These tools may focus on areas like cash forecasting, security, FX risk, intercompany settlements, or payment execution, often complementing and integrating with a TMS or ERP. Many of these offerings are cloud-native and modular, designed for seamless embedding into broader workflows. As the range and sophistication of these solutions continues to expand, treasury professionals are increasingly assembling flexible ecosystems tailored to their specific needs. This category is receiving dedicated coverage in a new sub-report this year.