Survey Results

Treasury Fraud & Controls

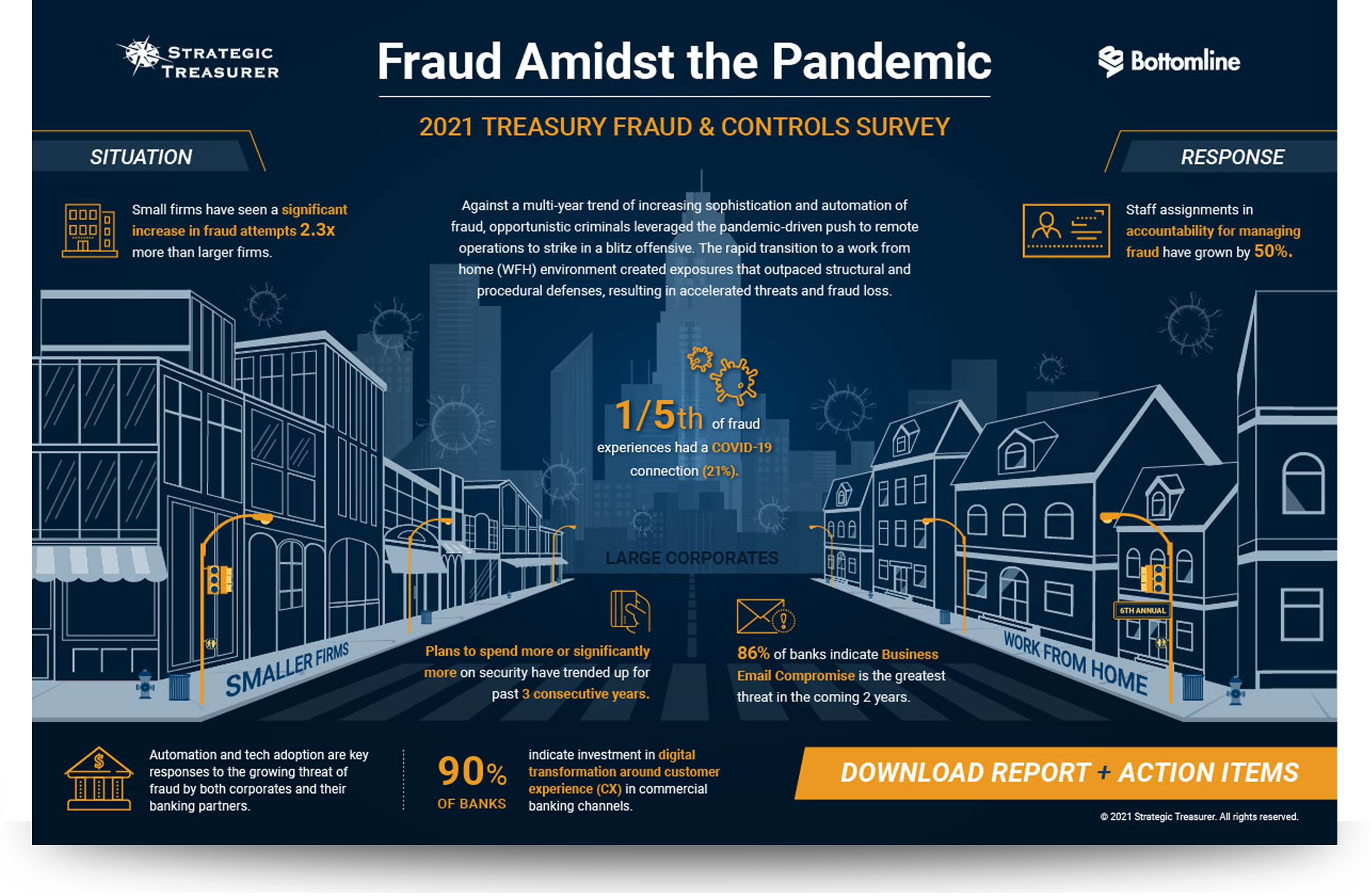

With your help, we’ve consistently found that fraud is a top ranking concern for treasury. This year, as it has become a bigger issue worldwide, we discover how your experiences and practices have changed. Has your security framework been strengthened? Or are you still doing the same things, hoping you’re not one of the many corporates who will suffer a loss from fraud in the next year?

Depth of Coverage

This annual survey seeks to evaluate the current and projected impact of fraud on the finance and treasury environment. Practitioners from all industries are polled on their experiences with fraud and on the range of controls, safeguards and security practices employed to protect their financial assets and information. Data related to bank account management and reconciliation practices is also gathered for a more comprehensive view of how various treasury operations impact security. This data is compiled annually and used to educate the industry on how the fraud landscape is evolving and how practitioners can better protect themselves and their organizations against attacks.

In this survey, treasury and finance professionals were asked questions on the following topics:

- Fraud Experience: Frequency of Attacks, Source of Attacks, and Method(s) of Attack

- Security Practices Employed (Both Human & Technological)

- Cyber Risk Management and Data Protection Policies

- Investments in Security & Fraud Prevention Technology

- Bank Account Management, Reconciliation & Compliance Practices

Treasury Update Podcast Episode

Listen in as Omri Kletter, VP of Fraud and Financial Crime at Bottomline, covers the implications of the results of the Treasury Fraud & Controls Survey with Host Craig Jeffery.

Access the Results Report

Thank you for your interest in our research. Upon submission, you will be sent a link to access the report. It can take a few minutes to receive the email. If you encounter any issues, please don’t hesitate to reach out to our team.