Achieving Bank Visibility

As the globalization of business continues to grow, corporations are realizing a need for greater visibility into their banks across the globe. However, the road to achieving complete bank visibility is long and complicated, especially for decentralized organizations. The purpose of this article is to shed light on the processes and steps involved with achieving complete bank visibility, and provide insight for companies that are considering undergoing such a project. The material contained here is designed to help you better understand the reasons why complete bank visibility is necessary and beneficial, and additionally provide a list of steps needed for an organization to achieve greater visibility.

Why Is Visibility Important?

In order to make well informed financial decisions on a daily basis, your team must have accurate, up-to-date and easily attainable bank information. Many organizations today claim to have cash visibility. However, upon further examination, their processes reveal daily visibility only to a small number of banks or bank accounts, with the majority of account information being reported on a weekly or monthly basis.

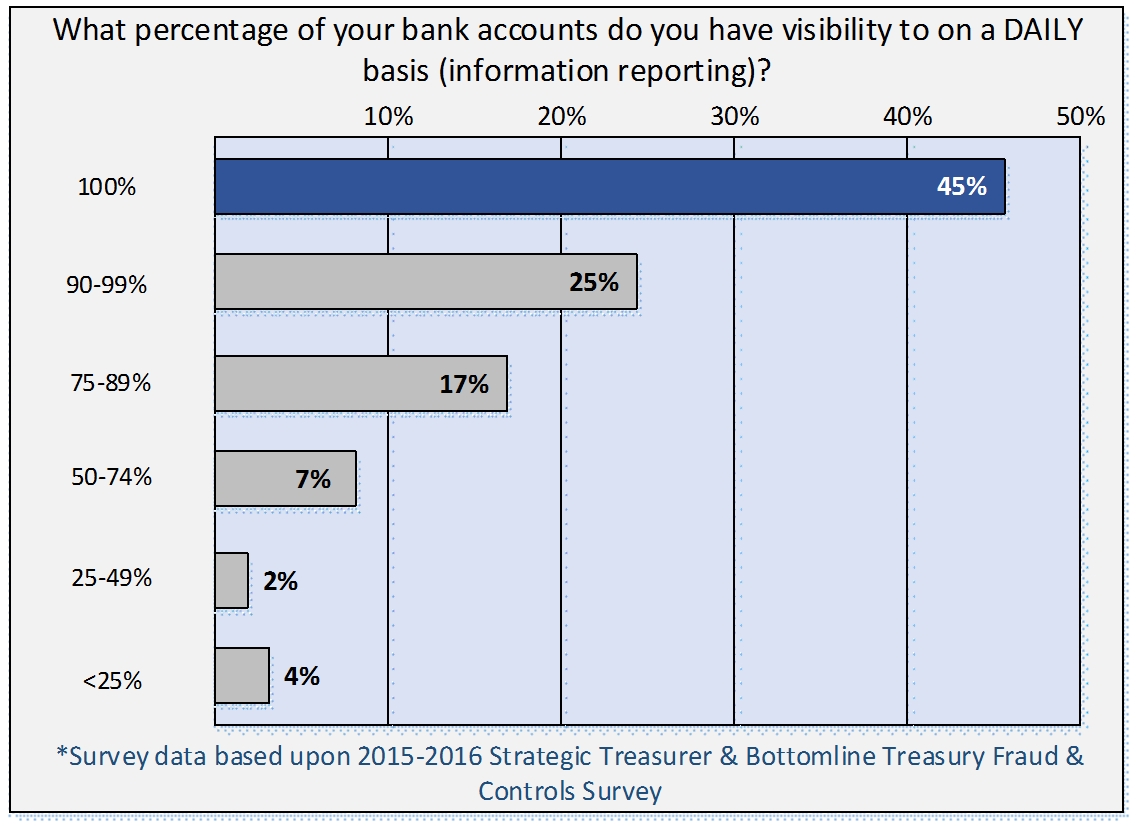

In the world of accounting, account reconciliation generally occurs on a monthly basis. This periodic approach tends to be taken for granted, and can even influence the decisions of the Treasury team when deciding upon an “acceptable” level of account visibility. Do we really need daily visibility? Wouldn’t weekly or monthly visibility be enough? The simple truth to these questions is: In the world of Treasury—if you have an account, you need to see its balance every day and, in many cases, its transactions. If you don’t need this visibility, you probably don’t need the account. This approach may sound extreme to organizations who are currently operating with a myriad of accounts. However, achieving daily visibility will allow you to more closely examine the transactions originating out of every account your organization has. This may lead to the realization that not all of the accounts are needed, and could serve as a guiding mechanism for you in consolidating your accounts, which would in turn reduce complexity and save money on unnecessary maintenance fees. According to a recent survey conducted by Strategic Treasurer and Bottomline Technologies, less than half of companies had daily visibility to all of their accounts.

In addition, daily visibility serves as a fraud prevention mechanism; any fraudulent activity will be spotted immediately, rather than days or weeks later. In today’s world, Treasury operations are increasingly being targeted by criminals as a viable target for fraud. In the same survey conducted by Strategic Treasurer and Bottomline Technologies, 56% of respondents indicated their companies had experienced payment fraud attempts within the last 12 months. Having immediate visibility helps to quickly identify unauthorized transactions or payments and could be the difference between a massive loss or a successful prevention. In short, if an organization wants to operate effectively and have quick access to bank account information, daily visibility is a must.

Challenges to Visibility & Knowing When to Upgrade Your Capabilities

For a treasury team functioning in a decentralized environment, a host of issues must be dealt with on a daily basis—from controls to visibility, the struggle for efficient processes and visibility is ongoing. Visibility specifically presents issues for decentralized teams due to differences in time zones, lack of redundancy in functions, and the inconsistency of information available from local banks. However, with the proper training and services, visibility is attainable for decentralized teams. The breadth of visibility required is made monumentally easier through the lens of a Treasury Management System (TMS). However, the transition to a TMS can be a time consuming and complicated process, especially for decentralized teams. It requires knowledge of specialized payment formats, payment systems and regulations within various countries, extensive amounts of paperwork and authorization, as well as a collection of aggregation partners—sometimes using a system of sub-aggregators who report to a central aggregator and thence to your TMS. This sounds complicated because it is—but it is well worth the effort to ensure efficiency for your team and visibility to your cash. For companies who become overwhelmed with the amount and complexity of work associated with a transition to a TMS, there are helpful resources available. This includes specialized Treasury consulting firms like Strategic Treasurer, who have the industry knowledge and experience necessary to lead an organization through the difficult implementation stages, and provide helpful insight on how to best utilize their new TMS capabilities moving forward (full disclosure, the author is a member of Strategic Treasurer).

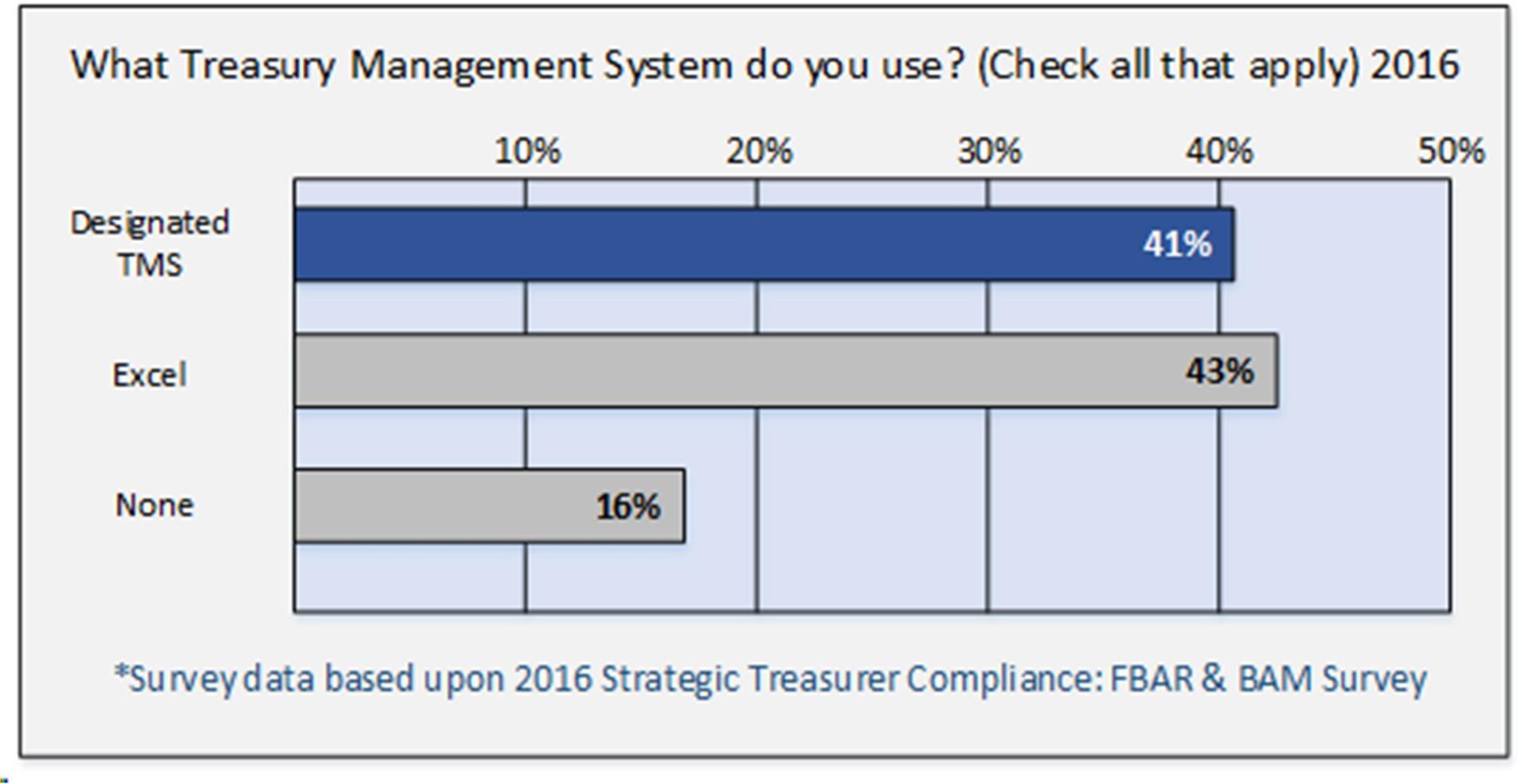

Evolving Visibility. The transition from visibility through Excel

Thanks to modern technology, there are now more options than ever available to corporates for achieving visibility to their cash. Due to dramatic changes occurring in the TMS landscape over the last decade, affordable TMS options have become available to midsize companies—providing comprehensive Treasury Management Systems with excellent visibility options, which include features such as dashboards that allow a company to view its global cash position, including money in different currencies, countries, accounts, etc., and up-to-date lists of global transactions. But this enhanced functionality is not necessarily needed by every company. Generally, most companies start with visibility through bank portals and Excel. Although these processes are heavily manual, error-prone and time consuming, It can be difficult to determine when and how to enhance your operations. For companies operating with only a few bank accounts, it is difficult to justify the expense of a TMS. But, now that there are more cash visibility TMS offerings in play it is easier to justify the use of a TMS since the cost point has shifted at this end of the TMS landscape. Putting small and medium businesses to the side, the number of companies using Treasury Management Systems is roughly equal to the number still using Excel, as indicated by the data acquired from the Strategic Treasurer 2016 Compliance: FBAR & BAM Survey. However, we expect the number of companies using Treasury Management Systems to rise as they become more affordable, business requirements continue to grow and awareness of their capabilities spreads.

When corporates actually do jump from Excel to a TMS, we often see them present their current excel spreadsheets and request that they be duplicated as closely as possible within the new system. Although misguided, this approach seems to make sense at first, given that the corporate’s employees are familiar with the spreadsheet format and would not be tasked with the burden of familiarizing themselves with a new layout. However, one or two years down the road, these corporations begin to realize that the new system was designed intentionally, to be functional and helpful. If your new system has been set up to mirror an old process rather than to fully utilize the built in capabilities that are available, you are severely restricting the options available to you. Understanding that it may be most efficient for your team to rethink their current processes may save you time and frustration down the road.

As you approach each potential TMS vendor, it’s important to allow them to view your daily cash position worksheet and other key reports and in turn, see how their system will display this information for you. You need a system with analytic tools and reports which will meet your daily needs as well as provide reports monthly, quarterly, annually, etc. which will match your organization’s requirements and display information in a user friendly manner. For additional insight and expertise on some of the leading TMS products currently on the market, download Strategic Treasurer’s 2015 TMS Analyst Report.*

Treasury Aggregators: How Do They Help?

If your organization does decide to implement a TMS, a key area of focus will be the aggregation of information reporting and payments. Your new system will run on information—a key piece of the puzzle which many organizations assume will be easy to get up and running. Unfortunately, this is not always the case. Instead, the implementation phase focusing on information reporting and payments can create significant delays to the overall project timeline, if the magnitude and complexity of this step are underestimated. In order to be adequately prepared for this phase of your implementation, the following questions must be addressed. Will you connect directly to the TMS? Will you connect directly with SWIFT? Will you leverage an aggregator or service bureau? Your responses to these questions often require the analyzation of your bank list and determining how the majority of your banks are able to connect, as well as examining your list of required payment types. Once you’ve narrowed this list down, you can select the most appropriate solution that fits your company’s needs.

When a bank can’t provide a standard format.

Ideally, you’d only do business with banks who can provide you with the most flexible and resilient solutions. The pricing they offer you would be low, and the quality of service would be high. Sometimes this happens with a couple of key banking relationships—but what about the others, the relationships you have to maintain in countries where regulations require in-country transactions or use of local accounts? The solutions provided by these banks often do not fit within the ideal schematics your team would prefer. They may not be able to provide consistent reporting, accurate reporting, or they report in a format that your internal systems are not compatible with. This is a multi-threaded topic and requires everything from careful relationship management to a flexible solution on your side which can receive non-standard formats without an overload of manual intervention. This sometimes requires assistance from a third party. When a bank can’t provide a standard format, you have a few options available to you.

- Reporting via Email

- Downloading Reporting from a Portal

- Screen scraping

- Having a Converter Built by the Aggregator

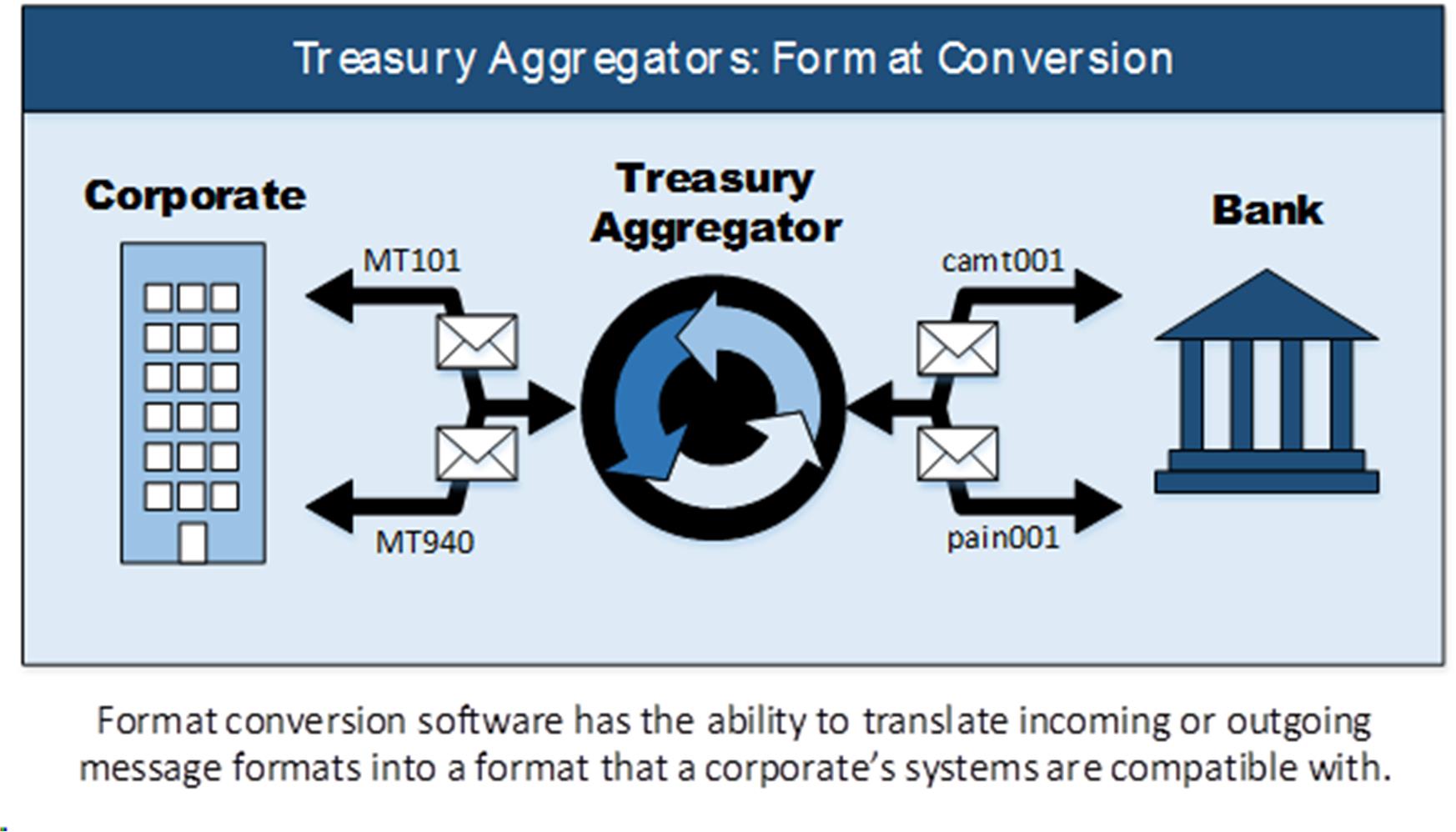

In all of these scenarios, a solution would be leveraged to move the unsupported formats into standard formats, which would allow you to access the data you need and integrate it into your systems. One solution that is gaining popularity in the world of Treasury is the use of a Treasury Aggregator to provide message format conversion software that can convert any unsupported message formats into a format compatible with your system and TMS. The graphic below is a simplified depiction of the role Treasury Aggregators play in message conversion.

Treasury Aggregators: The Deliverables

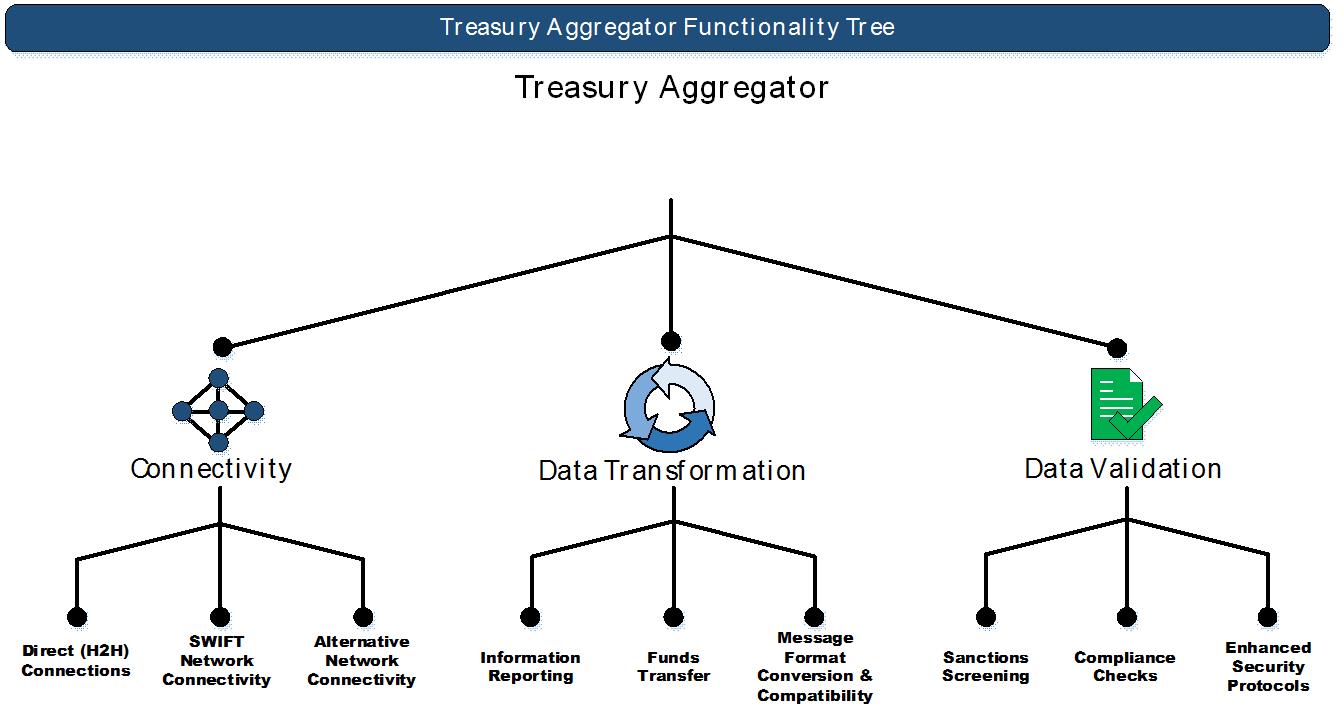

If you’ve determined an aggregator is right for your organization’s needs, your next step is selecting one. All selection projects are difficult—narrowing the field, sending out RFPs, interacting during demos, etc. If you know some key items to look for in the beginning, you’ll be able to simplify your search.

- SWIFT Connectivity. Find out what SWIFT messaging services they can offer you, as well as if you can leverage their BIC in addition to your own.

- Direct Connections. You may have banks which are not SWIFT connected, even if they appear to be at first glance. Or you may add a bank which isn’t SWIFT connected at some point. It’s best to choose a flexible solution that can accommodate these circumstances by connecting to the bank themselves.

- Payment Types. Ensure that you understand the payment types that will be available to you, as well as the connection methods through which each payment type will be sent. Flexibility, as mentioned above, is especially important when it comes to payments. Until Recently, SEPA (Single European Payments Area) was not a requirement, but now everyone who wishes to transact in the Euro Zone must comply with it. Make sure you select a provider who can keep up with ever-changing requirements and has enough flexibility built in to accommodate any changes down the road.

- Sanctions Filtering. A solution which can perform sanctions filtering on your behalf before payments hit the bank is crucial. If a bank blocks a payment for you, it becomes a reportable event. You want to have sanctions filtering built in at all levels of your infrastructure, and your aggregator should be the last stop before the bank.

- Customer Support Model. Adding banks can be a tedious process, and you want someone who will pursue this process for you tirelessly, not leaving you to struggle with unconnected banks months after you’ve begun your implementation. After going live, you need to know you have a team available to help you whenever you need them, who will be responsive and aware of your specific needs.

The graphic below shows some of the key areas of functionality provided by a Treasury Aggregator. For more information regarding the capabilities of Treasury Aggregators and a look at some potential vendors, Strategic Treasurer’s 2016 Treasury Aggregation Analyst Report will be released in May.**

Why Formats Matter

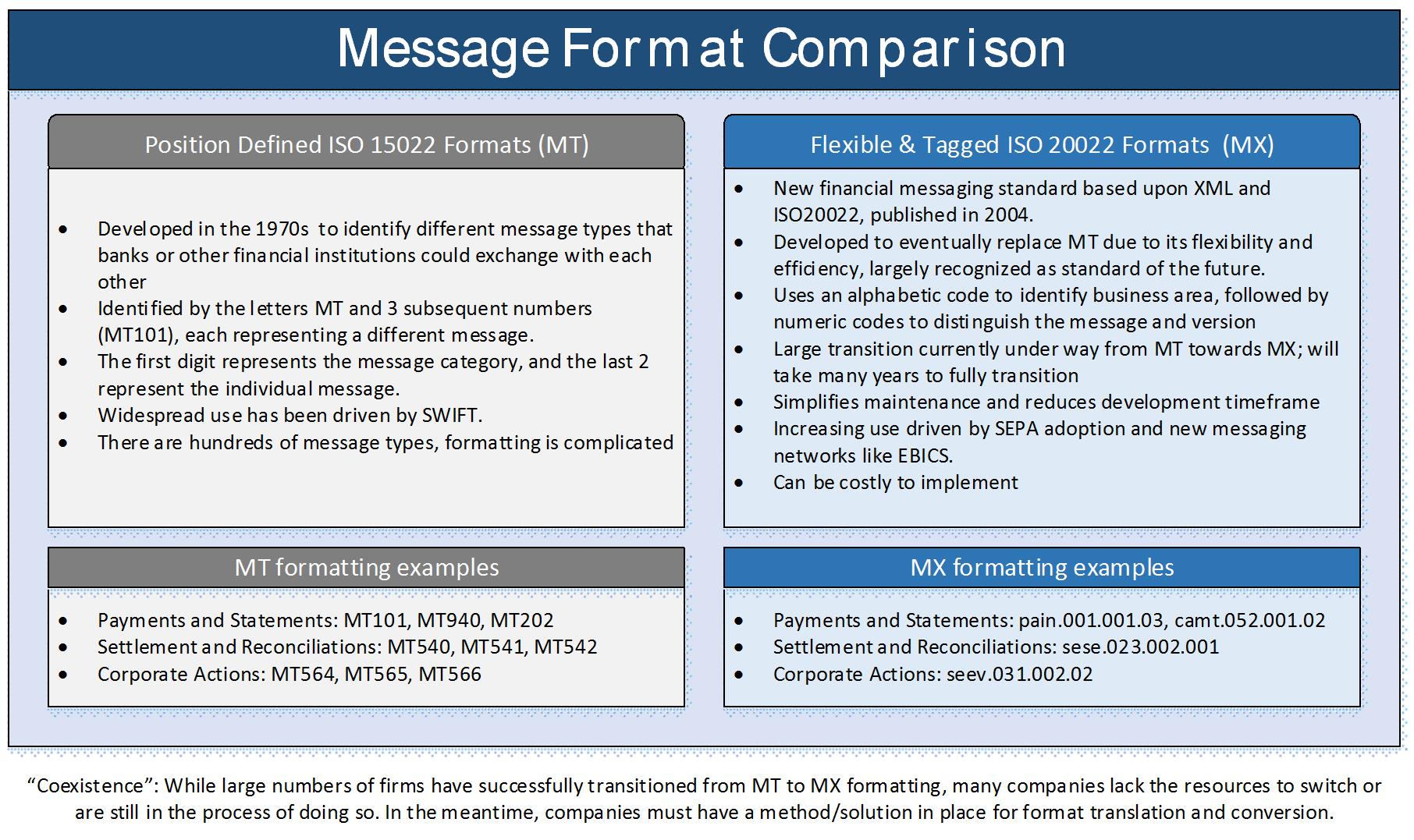

In today’s financial messaging landscape, there are two predominant message formats in use and several less common formats, all of which allow companies to exchange messages between themselves and their banks. However, these formats don’t automatically convert back and forth between each other, and thus a company must either pick one standard format for widespread use, or purchase message conversion software that can convert messages into a standard format. Both of these options involve deciding upon some standard message formats to be used by your company. How do you decide what format(s) you should pursue? You want to select a message type which will provide flexibility for your organization. Why does flexibility matter when it comes to messages? If there is a mistake in an MT message, treasury technology systems will not be able to integrate the message. SWIFT MT messages were designed in the 1970’s at SWIFT’s inception, and today are still the most common format used by financial institutions to exchange messages. However, the MT messages have a rigid formatting structure that complicates the message delivery cycle. In light of this issue, a new and improved message format, developed according to the ISO 20022 structure, is beginning to gain traction in the financial industry as its benefits are realized.

With the XML-based ISO 20022 structure, an errant message will often still be able to integrate with a TMS and there will only be an error in the specific field, rather than the entire message. This is helpful because most of the valuable information contained within the message is still available. For instance, if an additional field of enriched information is added, the results between and MT and MX message type would be significant. The MT (a delimited and positionally interpreted format) message would crash in the receiving system since position determines what the contents mean (the 4th field represents the transaction amount, if you insert something in the 2nd position, the 3rd field is now moved to the 4th position and the receiving system will interpret it as the amount field). The MX (a tagged record type) message, however, would still make it through properly. Inserting another enriched piece of data will also include the tags that define that data. If the system doesn’t understand it, it just won’t use it. The transaction amount will still be identified as the transaction amounts from the tags. That is, a $500.00 transaction amount will still come through as, conceptually, something like {TranAMT}500.00{TranAMT/}. The receiving system still has the means to interpret the data since the data comes through with its tags or descriptors. In essence, the use of an ISO 20022 message provides greater flexibility over the traditional MT format, due to its formatting structure. However, since both message types have widespread use today, any corporation attempting to exchange financial messages needs to have compatibility with each format.

Today, the most efficient method of acquiring the necessary compatibility is through a Treasury Aggregator. Treasury Aggregators have robust message conversion software that can take an MT or XML message, and transform it into a format that is accepted by a corporate’s systems. The graphic below shows some of the key differences between the traditional MT formats and the newer ISO 20022 formats.

Bank Reporting: Deciding Upon a Level of Service

Banks in some countries do not provide consistent reporting—a real problem when you are hoping to view your global or even regional cash position on a daily basis. Sometimes, banks cannot provide the correct information in various fields which are required for your system to read the data and properly tag it. At other times, banks are functioning on old platforms which only allow them to send data when there is transaction activity. This can cause a problem for two reasons—1) many TMS’s are built on balances, and if a statement is missing, the system will register this as an error; 2) you have no way of knowing if the bank simply failed to report due to an error on their part, if there is an error with your technical configuration (security keys have changed, for example), or if there was simply no activity. You can proceed with the assumption that there was no activity, but you may be deliberately overlooking a red flag that something is wrong on your side or the bank’s. Another issue which is faced with some countries is postdating. The bank will record transactions based on value date rather than settlement date. They will provide you with a prior day statement at the end of each day, which appears to be accurate, but then a few days later, a revised statement will be provided. When this happens, either an alternative setup is required (i.e. weekly or monthly reporting only), or daily manual intervention (making corrections manually in the system).

How Much Info? Choosing accounts for prior day and/or current day reporting.

Setting up the right reporting for your accounts is an integral part of establishing visibility. For some accounts, this will mean receiving current day reporting at key times throughout the day—before you finalize your cash position and after the ACH cutoff, for example. Some companies choose to receive current day reporting hourly, while others only want to see it once or twice. Some banks allow for any configuration you want and only charge for turning on the service as a whole. Others charge per report and have specific times from which you can choose. Others may only be able to provide hourly reporting, which can overwhelm your system with unnecessary data, eventually leading you to discontinue the service. Researching these options with each bank and making a determination for each account will help you set up the right options that best fit your needs and save you from unnecessary fees and headaches.

Conclusion

Achieving visibility is crucial to operating a successful treasury department. It’s important to be an advocate for visibility—to push for every account to have a purpose, and because it has a purpose, for its activity to be transparent. You may face opposition in your own department or in others, but achieving this and implementing flexible formats will be an excellent step toward future proofing your treasury department and enabling your team to respond quickly when a crisis arises. In the modern world, you will often find the most efficient method for achieving bank visibility involves the use of a TMS and a Treasury Aggregator. TMS’s and Treasury Aggregators simplify the banking processes of a corporation in many ways, including the management of connections to banks on behalf of the corporate, and providing enhanced dashboards that allow a client to quickly and accurately view their cash position. For any additional information regarding how to achieve visibility for your organization, or specific questions regarding Treasury Management Systems or Treasury Aggregators feel free to contact us.

Craig Jeffery

Managing Partner

Craig Jeffery formed Strategic Treasurer in 2004 to provide corporate, educational, and government entities direct access to comprehensive and current assistance with their treasury and financial process needs. His 25+ years of financial and treasury experience as a practitioner, banker and as a consultant have uniquely qualified him to help organizations craft realistic goals and achieve significant benefits quickly. He is responsible for overall relationship management and ensuring total client satisfaction on all projects.

Annie Reid

Director, Connectivity & Onboarding

Annie Reid is a Treasury Analyst working with Strategic Treasurer’s clients. A connectivity and bank onboarding specialist, she is the head of Strategic Treasurer’s bank onboarding team. When Strategic Treasurer’s clients make a major change that impacts their banking relationships, such as selecting new technology or a new treasury aggregator relationship, her team handles all of the ensuing communication and connectivity changes. This encompasses: information reporting and payments; making decisions regarding file formats and communication methodology; and handling all bank and technology firm calls and documentation management. For payment testing, her team creates a custom test case inventory and oversees and tracks all UAT and production testing. Annie works closely with SWIFT and is a SWIFT Certified Trainer currently delivering training to corporates and bankers on SWIFT for Corporates and Alliance Lite 2.