How Treasury Stands to Benefit from Blockchain:

Ripple’s Goal to Revolutionize Cross-Border Transactions

This article was originally posted in the Treasury Update Newsletter (Quarter 3, Fall 2017). You can see the full newsletter here.

Imagine a world where cross-border transactions can occur in real-time, at a few cents per transaction, to and from any bank, in any currency. Total transparency into the underlying transaction details, compliance requirements, and settlement information can be obtained at the touch of a button, and reconciliations are performed and validated across multiple ledgers to verify the accuracy of payment information. This is the mission that Ripple, an enterprise blockchain solution for global payments, has as part of its overall vision to create an Internet of Value.

What is Blockchain?

For those who remain in the dark regarding what blockchain actually is, the following is an easy-to-understand, consolidated definition given by IEEE Spectrum’s Morgan Peck: When you use a check to pay your mortgage, a series of agreements and contracts occur in the background between your financial institution and others that ultimately enable funds to be transferred from your account to someone else’s. Your bank can verify that you have available funds because it keeps records of where every penny in your account came from, and when. With blockchain, all of this background information is created and stored by software—specifically, a distributed and secure database called a blockchain (Peck1). Using blockchain, the process through which the ownership of funds passes from one person or entity to another is governed entirely by a network of validated computers (known as “validators” or “validator nodes”). These validator nodes have visibility to every transaction that is processed over their network, and work together to simultaneously authenticate and record every transaction as it occurs. Once a transaction has been validated, the underlying transaction details are posted on a shared ledger that can be viewed by all parties involved in the transaction. This has been developed as one of the key parts of how Bitcoin users know how much of the online currency they have. This can be helpful for Bitcoin investors to know, so they can continue trading to make more money or they could decide to visit some Bitcoin casinos to try and make some more Bitcoin. Some the best casinos for gambling with Bitcoin can be found at https://bestbitcoincasino.org/ for example. However, some users decide to spend their money online. Blockchain is useful throughout this process, so users can see their transactions.

Blockchain: Starting Out

When blockchain first burst onto the scene several years ago, it quickly became evident to some that the world of payments and connectivity had been altered in a major way. But despite significant advancements on the blockchain front, the impact of the technology on the financial landscape has not been so immediately apparent to everyone. Many organizations and financial professionals continue to have difficulty differentiating blockchain from bitcoin and the wider cryptocurrency world. At the same time, while many banks and Financial Technology Firms (FinTechs) quickly developed blockchain pilot environments and underwent Proof- of-Concept (PoC) tests, it took several years for legitimate blockchain use cases to surface. However, over time, a number of authentic applications have been introduced for blockchain technology, particularly within the financial realm. As these applications are refined, the emphasis for many blockchain solutions providers is shifting away from the development of the technology and towards promoting its use and raising awareness.

At this point in time, the emphasis for many blockchain solution providers is shifting away from the development of the technology and towards promoting its use and raising awareness.

The Corporate Environment’s Stance on Blockchain

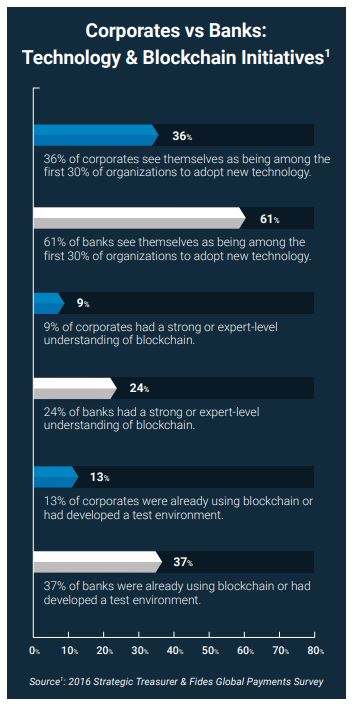

When it comes to new technologies, the simple truth is that most corporates are cautious as they evaluate new systems or processes, and prefer to wait until a solution or product has proven to have long-term value and stability before they consider implementing it for themselves. As with all technological innovation, it takes time, especially within the realm of corporate finance, for awareness and adoption to spread. In fact, data from the 2016 Global Payments Survey2 found that nearly two-thirds (64%) of corporates see themselves as middle-of-the-pack or late adopters of new financial technology. As part of the same survey, only 9% of corporates had a strong or expert-level understanding of blockchain, while 42% were completely unaware of it and 49% had only a basic or limited understanding. In light of this, it is clear that despite rapid advancements in blockchain, a significant portion of the corporate treasury environment still remains detached from its development and use as a payments rail.

Despite rapid advancements in blockchain, a significant portion of the corporate treasury environment still remains detached from its development and use as a payments rail.

The Banking Environment’s Stance on Blockchain

In direct contrast to most corporates, however, banks and FinTechs have proven themselves eager to explore the potential of new technologies, and tend to be more up-to-date with such developments as they occur. To drive this point home, 61% of banks see themselves as being among the first 30% of organizations to adopt new technology, compared to only 36% of corporates. This divergence in attitude is also evident when looking at corporate and bank approaches to blockchain. For example, 24% of surveyed banks indicated they had a strong or expert-level understanding of blockchain (compared to only 9% of corporates), and 37% of banks were either using blockchain in a test environment or had already introduced blockchain products to the market in 2016 (compared to just 13% of corporates).

As banks build out new technology, they will commonly partner with FinTech firms or third parties for additional expertise and support. In fact, data from the Global Payments Survey found that 68% of banks rely moderately-to-heavily on FinTechs and third parties when developing new payment capabilities. In 2016 and 2017, much of this bank and FinTech collaboration has focused on blockchain, and as it stands, there are several companies poised to significantly impact the financial landscape through their sophisticated blockchain solutions.

Blockchain: Gaining Traction

For some corporate finance and treasury professionals, the term “blockchain” may be nothing more than a buzzword; a fleeting trend that will be here one minute and gone the next. However, when looking at the level of investment that has been poured into the technology within the past several years, and at the advantages that the technology offers, it is clear to anyone paying attention that blockchain is here to stay. As familiarity with the ledger-based protocol continues to spread, there appear to be immense opportunities for increased efficiency, transparency, and security of financial processes. As this reality is recognized, a number of organizations, including financial messaging powerhouse SWIFT, FinTech giant IBM, and numerous global banks, have introduced blockchain-based platforms and applications to the market. As the blockchain market begins to take shape, one company that has stood out amongst their peers as a major industry disruptor has been Ripple, an enterprise blockchain solution for global payments and cross-border transactions.

When looking at the level of investment that has been poured into the technology within the past several years, and at the advantages that it offers, it is clear to anyone paying attention that blockchain is here to stay. This is why many have been so interested in bot trading which some have learned more about from websites similar to https://cryptoevent.io/review/bitcoin-revolution/. These have all cermented blockchain as a serious force in the finance industries.

Introducing Ripple

Ripple offers a blockchain-based payment network that can complete cross-border transactions in a matter of seconds, and offers cost-reduction and time-savings opportunities for banks and corporates alike. Ripple has secured $94 million in venture capital within the past two years, and now has over 100 banks and payment providers on their network, RippleNet, including UniCredit, Standard Chartered, and RBC. With such rapid growth and development, it appears that Ripple and their blockchain solution are poised to have a significant impact on the financial sector in the coming years. Their TMS and ERP-integrable product will soon be available for companies to complete real-time, transparent, and secure cross-border transactions – a major advantage over the current processes, where it can take several days for a cross-border payment to clear.

Ripple offers a blockchain-based payment network that can complete cross-border transactions in a matter of seconds, and offers cost-reduction and time-savings opportunities for banks and corporates alike.

In order to learn more about Ripple and their blockchain-based payments solution, Strategic Treasurer’s Isaac Zaubi corresponded with Asheesh Birla, Ripple’s VP of Product, to discuss the developments taking place at Ripple, and also what the finance and treasury landscape can expect from blockchain moving forward. The following Q&A held between Isaac and Asheesh provides insight on what Ripple is, how their blockchain payments platform works, what the advantages are, and most importantly, how treasury can benefit from blockchain technology to increase the speed, compliance, transparency, and security of cross-border transactions.

ISAAC: TELL US ABOUT RIPPLE AND THE MISSION THAT YOUR TEAM

AIMS TO ACHIEVE.

ASHEESH: Ripple characterizes itself as an enterprise blockchain solution for global payments. Ripple’s mission is to create an Internet of Value (IoV) where money moves as quickly as information does today. For corporate treasurers, our solution for instant, transparent, and low-cost international payments provides capabilities that allows them to effectively manage their liquidity and cash flows, and achieve greater control over their payment activity.

Ripple itself is headquartered in San Francisco, with offices in New York, London, Luxembourg, Mumbai, Singapore, and Sydney. To date, we have raised nearly $94 million in funding, employ over 170 people worldwide, and have nearly 100 customers – about 90 of which are banks and 80 of which are deploying Ripple solutions commercially – these customers are a mix of banks and non-banks, including payment providers.

ISAAC: HOW DOES RIPPLE’S PAYMENT NETWORK/PLATFORM DIFFER FROM THE CORRESPONDENT BANKING MODEL AND CURRENT CROSS-BORDER PAYMENT PRACTICES?

ASHEESH: The correspondent banking model is largely based on SWIFT (the Society for Worldwide International Financial Telecommunication) and its messaging system, which was invented in the 1970s. We think using this system to transfer money overseas is antiquated and inefficient. Using this system, which relies on one-way messaging, cross-border payments take 3-5 days on average to complete, often fail, and are not transparent – the beneficiary does not know when the payment will arrive, or exactly how much will be charged for its delivery. If the payment fails, the involved parties do not always know why. Last but not least, it’s expensive; margins of 3% or more are often charged on these payments. In fact, the fastest way to get $10,000 from San Francisco to London right now is to just pack it into a suitcase, and fly it there.

We think the experience of sending money should live up to the standards of today’s technology. Our enterprise blockchain solution for banks, called xCurrent, uses a two-way messaging system between the sending and receiving bank. When a payment is initiated, all of the information regarding that payment – including KYC data, bank fees, and compliance information – is sent to the beneficiary bank BEFORE the payment is delivered. If any information is missing, the payment is halted and the sender can be notified that they need to provide additional transaction details. Once all the pertinent transaction details have been prepared and approved, the payment can be completed and both the sender and receiver have instant verification that the funds have been transferred.

When a payment is initiated through Ripple, all of the information regarding that payment – including KYC data, bank fees, and compliance information – is sent to the beneficiary bank BEFORE the payment is delivered.

ISAAC: HOW DOES A TYPICAL TRANSACTION CONDUCTED OVER

RIPPLE WORK (I.E. WHAT STEPS ARE INVOLVED AND HOW LONG DOES IT TAKE?)

ASHEESH: Ripple is truly unique in that it combines modernized messaging with settlement. This is very important to treasurers – and corporates more broadly – because it solves problems, such as invoice reconciliation. Each payment sent by Ripple is pre-validated to ensure its accuracy and validity. This includes checks on all relevant payment information, including compliance details (on the sender, beneficiary, and nature of the payment), invoice details, bank fees (including FX rates and processing fees), customs declaration forms, and more. Payments cannot be sent through Ripple until this information is obtained and available for viewing by all parties involved in the transaction.

Ripple payments are broken down into two phases: pre-transaction negotiation, and payment settlement. In the pre-transaction negotiation phase, all banks involved in the payment exchange compliance and fee information with each other. Each bank involved signs off on processing the payment after verifying details of the sender and receiver (e.g. account numbers, fees, and compliance checks) in order to reduce common causes of failed payments – such as missing or incorrect beneficiary account details. After all banks involved agree to process the payment, settlement occurs instantly across the network. This is called the payment settlement phase and takes a matter of seconds to complete. Once a payment has settled, Ripple’s distributed-ledger technology documents the transaction details and shares the information with each party so that they can immediately compare their records for reconciliation purposes.

ISAAC: WHAT’S THE RISK OF FRAUD/SECURITY BREACHES FOR THE PLATFORM/NETWORK? HOW DO YOU ENSURE THE NETWORK’S SECURITY?

ASHEESH: Ripple’s approach to building the Internet of Value (IoV) is similar to the distributed approach on which the Internet is built. Ripple and the Internet are built on distributed architectures, meaning there is no central database or system through which transactions or data flow. Ripple’s solution works on a peer-to-peer basis where individual banks run Ripple software making them a node on the network. Using Ripple software, bank nodes directly communicate and send payments between each other using advanced security features and cryptography without the need for a central operator, database, or system. Distributed systems reduce attack vectors because there is no singular, centralized system to hack that will compromise the network.

ISAAC: WHAT ARE THE ADVANTAGES OF THE RIPPLE SOLUTION FOR BANKS AND CORPORATES?

ASHEESH: For banks, our solution enables them to provide their customers (both corporate and retail) with a secure, transparent, and cost-effective payments experience. In addition, it helps banks to manage their own resources and achieve greater visibility over transaction details when processing cross-border payments for their corporate and retail customers. Payments can be conducted at greater speeds and at lower costs.

The primary benefit to corporates, as realized through a faster, more transparent, and more certain payment experience, is the improved ability to manage global liquidity. Knowing exactly when a payment will reach a supplier, distributor, or manufacturer, as well as the fees associated with each payment, can free up crucial liquidity, drive down the cost of doing business, and increase treasury’s ability to maintain visibility and control over cash. This is particularly relevant for corporate treasurers of large multinational corporations as they manage multiple pools of liquidity and cash balances across multiple markets. Additionally, as payment details and compliance information are validated before a payment is sent, Ripple’s payments process significantly reduces the chance of errant or delayed payments, and cuts back on the possibility of a payment violating any sanctions or compliance restrictions. It also allows organizations to conduct dispute resolution and reconciliation functions almost instantly; a major advantage that saves time and limits the possibility for fraud.

The primary benefit of using Ripple for corporates, as realized through a faster, more transparent, and more certain

payment experience, is the improved ability to manage global liquidity.

ISAAC: WHAT ARE SOME RECENT MILESTONES THAT RIPPLE HAS ACHIEVED?

ASHEESH: We have achieved many significant milestones over the past couple of months that clearly demonstrate the commercial traction of – and demand for – our enterprise blockchain solution for payments. We have raised nearly $94 million in venture capital over the past two years, and just opened new offices in Mumbai and Singapore, our sixth and seventh locations worldwide, to service growing customer demand for our solution. We also recently announced a partnership with DAYLI Financial Group to bring Ripple’s solution to South Korea.

Over the course of July, we announced the results of our collaborations with two of the world’s leading central banks: the Federal Reserve, and the Bank of England, both of which studied Ripple’s technology solution to improve cross-border payments. The results were positive, and indicated these central banks see real application of our solution to their cross-border payment needs. At this point in time, we have nearly 100 banks uploaded to our network, including RBC and Standard Chartered, and expect many more in the coming months.

In July, Ripple announced results of their collaboration with two of the world’s leading central banks: the Federal

Reserve, and the Bank of England, both of studied Ripple’s blockchain solution to improve cross-border payments.

ISAAC: WHAT CAN WE EXPECT FROM RIPPLE MOVING FORWARD?

ASHEESH: Our long-term vision is for the pain points currently associated with cross-border payments to be removed with our enterprise blockchain solution and network. Payments across borders are slow, expensive, and inefficient for banks and corporates – we want to take the friction out of sending money overseas. On a more granular level, we expect the Ripple network to have expanded to all corners of the globe, connecting banks, non-banks, corporates, and consumers across different markets and enabling them all to make instant cross-border payments. In the short-term, however, we look forward to seeing more corporates join the Ripple network to take advantage of our new product, xVia, a simple API through which they can connect and easily move money overseas. We are excited to be beta testing xVia with select corporates this year.

Conclusion

Whether organizations are ready or not, blockchain is on the verge of entrenching itself within the financial landscape. The use of blockchain-based technology for payments and cross-border transactions, as showcased by Ripple, has demonstrated significant advantages for both corporates and banks in the areas of security, speed, transparency, and cost-effectiveness. Where treasury is concerned, the use of Ripple or other similar networks/services could provide promising benefits over current payment processes, especially those inherent in the correspondent banking model.

However, before Ripple or any other blockchain-based payments provider can further establish themselves, there are a number of hurdles left to overcome. Today, the incumbent and long-standing financial messaging provider, SWIFT, dominates the landscape and has over 10,800 institutions utilizing their platform across more than 200 countries and territories. With such an extensive and well-established network of users, many organizations may be reluctant to scrap their current infrastructure for a technology and service that is still in its early stages. At the same time, SWIFT is working on their own blockchain-based payments services through their global payments innovation (gpi) directive, and are gaining headway. If SWIFT is able to build out their blockchain capabilities further, they may be able to leverage their already-robust network of corporates and financial institutions to foster adoption of their solution over others.

In either case, however, there is no doubt that blockchain-based payments technology is gaining strong momentum in the financial realm and is poised to play a pivotal role in facilitating cross-border transactions for both corporates and banks in the years to come. And whether it is Ripple or another provider leading the charge, the advantages for treasury look promising. The end result? Moving forward, treasurers should begin to familiarize themselves with this new technology. Blockchain is here to stay.

Footnotes:

1. Peck, Morgen. “Blockchains: How They Work & Why They’ll Change the World.” IEEE Spectrum. 28 September 2017. Web.

2. 2016 Strategic Treasurer & Fides Global Payments Survey

Editor’s Note: Many thanks to Asheesh Birla, Sarah Marquer, and the staff at Ripple for their willingness to participate in this piece. It is this openness to discuss that allows us to generate meaningful content that covers real and current industry challenges, viewpoints, and concerns.

-Isaac Zaubi, Publications Manager, Strategic Treasurer

Isaac Zaubi

Publications Manager, Treasury Analyst

Isaac Zaubi has been with Strategic Treasurer for over 2 years as a treasury analyst before coming into his current role as Publications Manager. Isaac’s contributions center primarily around the development and management of publications, including fintech analyst reports, survey results reports, e-books, and whitepapers.