How Should Treasury Respond to Disruptive Technology?

This article was originally posted in the Treasury Update Newsletter (Quarter 4, Winter 2017). You can see the full newsletter here.

The Disruptive Buzz Builds

Whether it’s blockchain, bitcoin, or AI, the topic of disruptive technology has become a common talking point for treasurers. Though much of the talk is still speculative, there are segments of the industry where disruption is already occurring. Over the past several years, many of the technologies categorized as “disruptive” have seen rapid development from proof-of-concepts into legitimate applications with real-world advantages and use cases. With more mainstream traction heading into 2018, many are now focusing on the potential of such innovations to transform the business environment. However, due to the hype surrounding the topic and the claims made by some proponents that disruptive technology is set to replace human labor, many practitioners have also begun to view these developments with a mixture of uneasiness and skepticism. Will treasury’s role soon be overtaken by “robots?” Can every task performed by treasury be completed by a machine? As the buzz continues to build, the questions that treasurers have continue to mount.

The Disruptive Tech Spectrum

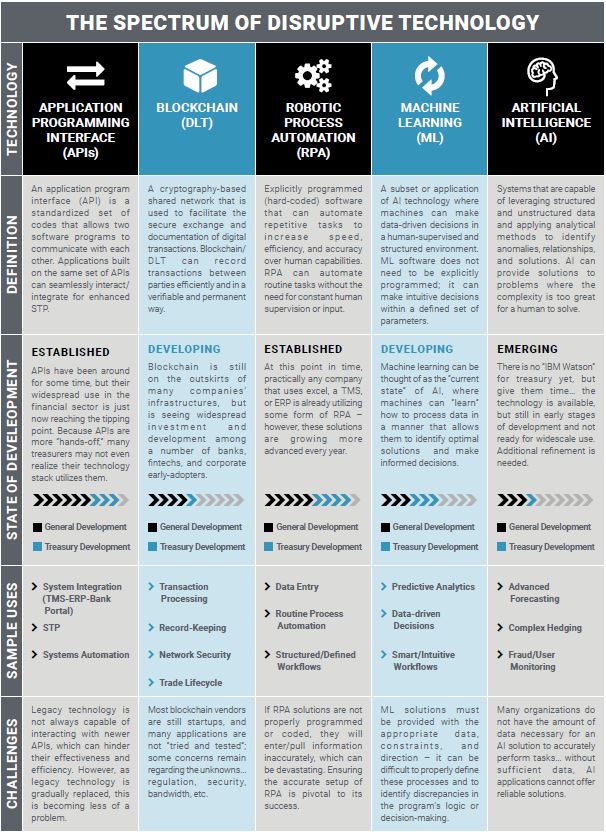

Within the past decade, five areas of technological “disruption” or innovation have stood out as generating significant commotion in finance. These include:

- Robotic Process Automation (RPA),

- Blockchain and Distributed Ledger Technology (DLT),

- Machine learning (ML),

- Artificial Intelligence (AI), and

- Application Programming Interface (APIs).

The diagram below provides a breakdown of these technologies and their application to treasury.

While all of these technologies are collectively presented as being new and “disruptive,” in reality, many are probably already being used in some area of your financial group through an ERP, TMS, or other platform. At this point in time, a number of fintech vendors have already incorporated some form of machine learning or automation software into their solutions. There are a number of forecasting and hedging solutions available that utilize predictive analytics (ML) functionality, and functions such as reconciliations, invoice processing, or other data entry tasks are increasingly being performed via automated programming (or RPA). A modern-day TMS may also utilize APIs to pull statements from multiple bank platforms in a fraction of the time it would take a human. Even blockchain applications, while still on the outskirts of many organizations’ infrastructures, have begun to see heightened interest as a viable option for functions like reconciliations and transaction processing.

Rise of the Machines?

As the evolution of financial technology continues, many treasurers are finding that a greater number of both operational and strategic processes can be performed more accurately and efficiently by machines. In fact, in some cases, entire functions previously carried out by treasury staff are now performed by a technology solution. As this trajectory continues, practitioners may find themselves wondering if their position is under threat from a machine.

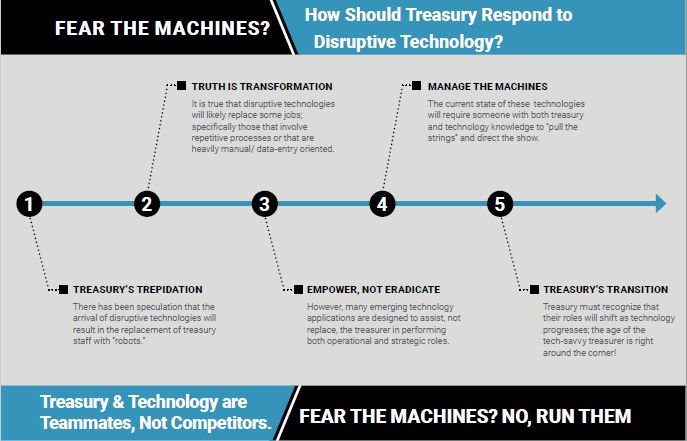

Fear the Machines? No, Run Them

I will not even attempt to answer this question for the long-term; technology is progressing at such a torrid pace that offering a 10-15 year outlook is troublesome at best. However, in the short-term, treasury must recognize a new reality. Their positions aren’t being replaced; rather, their roles are shifting. As it stands today, some treasury and finance-related positions are better performed by machines. In fact, almost all of treasury’s tasks can be aided or enhanced through the proper utilization of the right technology solution. Rather than being replaced, treasury’s responsibilities are evolving to account for the increasing importance that technology plays. To be more direct; treasury’s role moving forward will require tech-savvy operatives who possess the wherewithal to direct financial technology applications in a manner that optimizes treasury operations.

Treasury & Technology are Teammates, Not Competitors

While technology can always be equipped to handle more processes, analyze more data, and automate more tasks, there will always need to be a conductor; someone with an innate knowledge of both financial strategy and technology to pull the strings and direct the machines. Given that this looks to be the trajectory for treasury’s responsibilities, what should treasury’s response be? Is there anything treasury should be doing now to prepare for the impact, or is it better to wait passively until these technologies develop further? As treasury professionals evaluate their next steps, the following Q&A should help draw attention to some of the important factors that must be considered.

Treasury’s role moving forward will require tech-savvy operatives who possess the wherewithal to direct financial technology applications in a manner that optimizes treasury operations.

WHAT PROOF DO WE HAVE THAT DISRUPTIVE TECHNOLOGIES WILL HAVE AS SIGNIFICANT AN IMPACT ON THE BUSINESS ENVIRONMENT AS THE “EXPERTS” ARE PROJECTING?

As stated previously, many RPA, API, and ML applications are already having an impact in the financial realm. They have proven effective at streamlining communications between systems (APIs), automating tasks from reconciliation to payment processing (RPA), and aiding in strategic functions such as cash forecasting and hedging (ML). Regarding blockchain, a number of legitimate use cases have surfaced over the past 2-3 years that could revolutionize electronic transactions and record-keeping. Furthermore, when looking at the billions (yes, billions with a “b”) of dollars that have been pumped into the development of emerging technologies over the past several years, it is clear that these technologies are here to stay. IBM, Google, Apple, American Express, JP Morgan… anyone that considers themselves a leader in technology or finance is involved with at least one (but in many cases, all) of these technologies. As larger companies push the envelope in terms of capabilities, services, and applications, it is only a matter of time before the broader market follows suit.

WHAT IS THE OPTIMAL BALANCE OF TREASURY AND TECHNOLOGY EXPERTISE?

A treasurer 50 years ago may have performed the majority of his or her tasks with a pen and paper. Over time, this practice was replaced as computers, spreadsheets, and other technology applications became available. But this progression does not mean treasury is now the new IT. Should you be performing treasury-specific calculations by hand today? No. Should you be memorizing the specific codes and programming languages used by financial software? As a treasurer, no. But should you understand the application of financial formulas and know how to operate the financial technology that can quickly calculate them for you? Yes. The emphasis should be on applying the technology, not creating it, and understanding treasury operations, not manually performing them. It’s all a balancing act. Recognize that technology enables you to better perform the tasks you are assigned, and then learn how to apply technology to achieve the desired results. Also, recognize that as technology continues to evolve, the optimal balance of treasury and technology expertise will shift as well.

IF DISRUPTIVE TECHNOLOGIES ARE THE FUTURE, HOW LONG DO WE

HAVE BEFORE FAILING TO UPGRADE OUR INFRASTRUCTURE WILL PUT US AT A SIGNIFICANT DISADVANTAGE?

It depends on which technology you have in mind. Given the widespread use of RPA, API, and ML applications today, many would argue that not utilizing such technologies now is already putting you at a disadvantage. Given the efficiencies and time/cost savings that these automated functions can provide treasury, there is already a strong case to be made for their adoption. With regards to other solutions such as blockchain, there is probably another 3-5 years before heavy mainstream adoption takes shape. While it is not yet clear which specific use or application of blockchain will see the most success, its use for functions like transaction processing, security, and record-keeping are seeing the most traction currently. Where AI is concerned, we are still waiting for the “Watson” or “Cortana” of treasury to save us all, but ML-based functions (we consider predictive analytics and other machine learning applications to be a form of “smart” technology) already exist and are proving to be advantageous in performing a number of key tasks. As these ML applications continue to be refined, their

use in the financial landscape for functions such as forecasting, hedging, and investment management is seeing increased adoption. Similar to blockchain, the next 3-5 years should be crucial for growth in the ML market.

WHAT ARE THE KEY CHALLENGES, ROADBLOCKS, OR RISKS THAT EXIST WITH REGARDS TO DISRUPTIVE TECHNOLOGY?

The current issues stemming from disruptive technologies include complications in the original programming and calibration of RPA solutions. Because RPA solutions operate based on a set of pre-programmed rules and constraints, any errors or alterations in this programming stage would cause severe repercussions down the road. For technologies such as blockchain, most vendors are still start-ups. This makes choosing a winning solution challenging and risky. Additionally, the security and immutability of blockchain and distributed ledger technology (DLT) is still being called into question by those not convinced of the technology’s claimed impenetrability. With APIs, a common issue would be the inability of legacy technology to integrate with newer applications, as the programming language the older solutions are based on is not always compatible with newer codes. For ML applications, the primary challenge involves structuring data in a way that enables machines to make intelligent decisions. For organizations with outdated or incomplete data-sets, this represents a major problem, as any ML solution they implement would be operating off inaccurate information. The same challenge exists with broader AI solutions. The level of data a true AI solution (one that can make complex decisions entirely on its own) needs access to must be so massive and so precise that most companies do not have the bandwidth to justify its use. Finally, the regulation of many of these technologies is not set in stone. Many different regulatory bodies may be imposing constraints on the use of certain applications moving forward, which means that the adoption of such a solution now could result in obstructed use down the road.

WHAT WILL THE ULTIMATE IMPACT OF THESE TECHNOLOGIES BE FOR CORPORATE TREASURY STAFFING, PROCESSES, AND STRATEGIES?

Treasury is going to have to learn to coexist with technology, but instead of dreading this shift, treasury personnel must recognize its advantages. While it is true that some manually-intensive treasury positions will be replaced by technology, other positions will be enabled by technology and entirely new positions may be created as well. Instead of performing tasks manually, treasury is now simply managing the machines that perform the tasks. This shift in roles allows machines to process more data at greater speeds and with greater accuracy, and frees up more time for treasury to respond and act on the data, rather than having to gather or process it. Ultimately, the winner of these efficiency gains is treasury.

WHAT STEPS CAN WE TAKE NOW TO PREPARE FOR THE IMPACT OF THESE TECHNOLOGIES?

Knowledge is power. Even if you or your company does not have any current plans to implement emerging technologies, staying up-to-date on developments would be prudent. It would also be wise to begin having conversations with your banks and TMS/ERP providers regarding their plans to incorporate emerging technologies into their products and services. It could be that these vendors are already working on implementing these products or have already introduced applications. As treasury identifies these developments, they should be open to learn and understand how they can use new applications to improve operations. Before any implementation or major restructuring, it is vital that treasury have a well-rounded knowledge of the solutions they will be working with, and each staff member should be familiar with the technology components they will have to use. A car is much faster than walking, but only if you know how to drive it. The same is true with treasury technology; the only way efficiency gains will be realized is if treasury knows how to optimize the machines’ usage.

Final Thoughts

How Should Treasury Respond to Disruptive Technology?

Should treasury shrug off disruptive technologies as another fleeting trend? No. Should treasury fearfully approach the future with the dread of knowing their positions will soon be replaced by autonomous robots? Also, no. Rather, treasury should accept that technology continues to progress and as a result their roles will shift. While many treasury groups already rely heavily on technology to manage certain functions, its importance will continue to increase as more applications and innovations are introduced. And developments are happening quickly. Thus, it would serve treasury well to get a handle on the technology side of treasury and familiarize themselves with the leading applications. Rather than be out of a job, treasurers will likely find that the use of disruptive technology only furthers their ability to complete tasks and make strategic decisions. In fact, the strategic application and management of financial technology looks to be one of the more important roles that treasury could play moving forward.

So, the final advice for treasury? Spend time studying the developments and applications of leading technology solutions. Be proactive in identifying areas where your company could benefit and where your operations could be streamlined. Learn how you can best modify your roles to coincide with the strengths of new technology applications so that your department can function at the highest potential. The age of autonomous robots has not yet arrived. The age of the tech-savvy treasurer, however, is right around the corner.

Isaac Zaubi

Publications Manager, Treasury Analyst

Isaac Zaubi has been with Strategic Treasurer for over 2 years as a treasury analyst before coming into his current role as Publications Manager. Isaac’s contributions center primarily around the development and management of publications, including fintech analyst reports, survey results reports, e-books, and whitepapers.