Key Takeaways: 2017 Compliance Survey

Strategic Treasurer’s fourth annual Compliance Survey found that compliance continues to be a mixed bag for treasurers. Although treasurers have increased their awareness of certain compliance topics, there are still many issues with which treasurers are not only falling behind, but also failing to comply. Some of the key survey findings are highlighted below.

FBAR

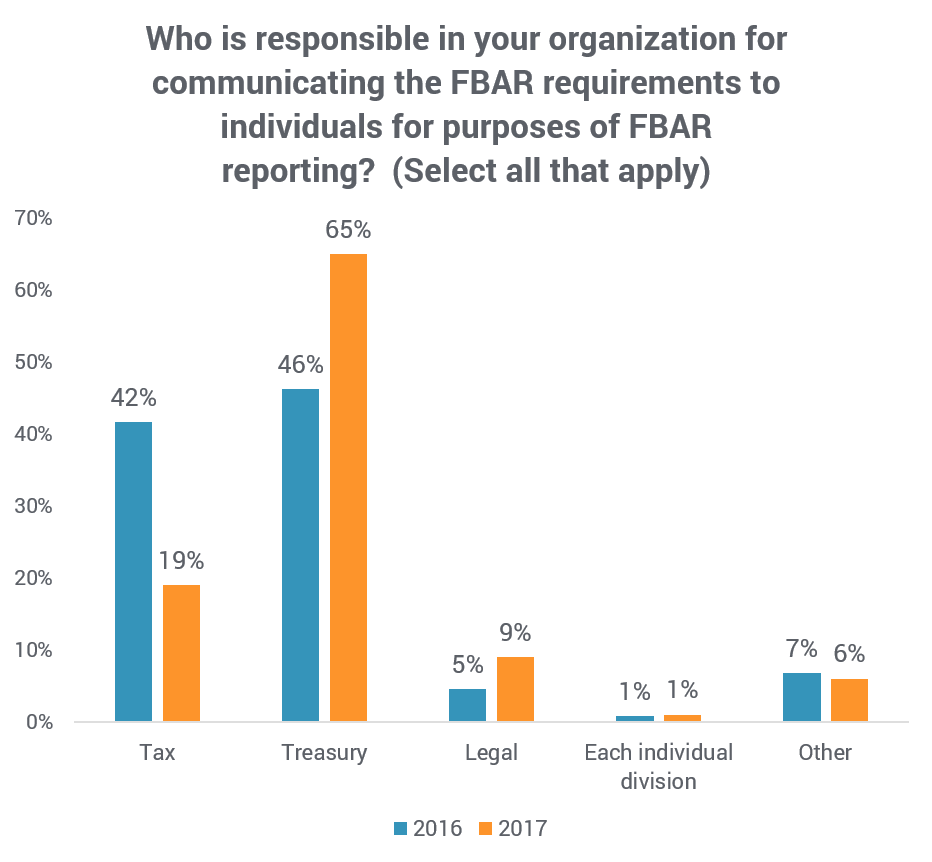

Foreign Bank Account Reporting (FBAR) has been an item of interest to treasury for several years now. However, compared to previous years, the number of treasurers who were fully aware of FBAR and its requirements for individual signers decreased in 2017. There could be several reasons for this. First, there is movement in the finance field and as new people enter into Treasury and experienced worker retire, there is a learning curve for that department. It could also be due to the repeated delays on the filing deadline, which caused treasury to shift their focus to other areas. As it stands now, approximately half of respondents have already filed on behalf of their individual signers for 2010-2016, while half have yet to file. With regards to FBAR information gathering (lists of signers, account balances, etc.), treasury is the department most frequently responsible, and the 2017 survey showed that this responsibility has continued to grow. Although the FBAR individual filing requirements have been routinely postponed (2010-2017), with the most current due date April 15, 2018, there have not been any further delays, the requirements are now live, and companies must be prepared to comply or face stiff fines.

eBAM

In recent years, the rise of electronic bank account management solutions (eBAM) has caught the spotlight, especially as regulations such as FBAR took on greater importance. However, data from the 2017 survey show that spreadsheets still reign supreme in the bank account management sector. Even though TMS usage is on the rise, the use of eBAM functionality as a component of a TMS or other software solution remains low, and 57% of respondents were still using spreadsheets for bank account administration. One of the reasons for this lack of eBAM adoption could be that the majority of respondents (75%) found their current system for bank account administration to be working well, even if some improvements are needed. Looking towards the future, however, there looks to be significant potential for the adoption of eBAM solutions, as 35% of respondents had plans to adopt eBAM tools in the next 5 years. Between 2016-2017, the use of eBAM tools increased from twelve to sixteen percent.

SWIFT CSP

First released in 2017, SWIFT CSP requirements affect any corporate utilizing the SWIFT infrastructure, and organizations were required to be compliant with CSP beginning on December 31, 2017. Our 2017 Compliance Survey was live from early November to early December 2017 and given the close proximity between the survey run-time and the CSP deadline, the expectation was that most treasurers would already be compliant with this regulation. And while 56% had already completed or were in the process of completing the CSP process, a significant number of respondents (44%) had not yet started. Furthermore, a full 31% of treasury professionals were still not fully aware of the SWIFT CSP requirements and what they entailed. Given that the deadline for CSP attestation has now passed, it is vitally important that treasurers understand the implications for their firm. Learn more about SWIFT CSP here.

GDPR

Approved in April of 2016, the General Data Protection Regulation (GDPR) is a European regulation designed to strengthen the protection of personal data of European Union citizens held by 3rd parties, including corporations and banks. The regulation will go into effect by May 25, 2018. This regulation applies to all companies regardless of their domicile if they have information on European citizens. Though non-compliant organizations will face heavy fines once enforcement is official, many treasury professionals still do not know about GDPR and its implications. Only 7% of those surveyed responded that they are aware and ready for the GDPR regulation. Given the vast amounts of personal data received by companies through gated content and electronic resources, it would be wise for treasurers to research GDPR and begin making changes in how they collect and store personal information. Learn more about GDPR here.

More Information

To hear Strategic Treasurer Senior Consultant and CTP Stephanie Villatoro’s comments on these survey results, view our webinar here.

Craig Jeffery

Managing Partner

Craig Jeffery formed Strategic Treasurer in 2004 to provide corporate, educational, and government entities direct access to comprehensive and current assistance with their treasury and financial process needs. His 25+ years of financial and treasury experience as a practitioner, banker and as a consultant have uniquely qualified him to help organizations craft realistic goals and achieve significant benefits quickly. He is responsible for overall relationship management and ensuring total client satisfaction on all projects.