Survey Results

B2B Payments & WCM Strategies

Payments, especially B2B payments, are rapidly changing. Have the industry’s opinions on new and emerging technologies changed? What is currently considered the “best” payment type? How does working capital affect, not only payments, but also all of treasury? Learn more about these top takeaways in this year’s survey report.

Depth of Coverage

While you may find other surveys that briefly poll the market, our research goes well beyond the surface and asks dozens of question sets across multiple strategic and operational areas within treasury to uncover truly informative and actionable data – insights with depth of understanding and breadth of context.

In this survey, treasury and finance professionals were asked as many as 105 questions (broken out by branching logic to relevant respondents) on the following topics:

- Spend Relationships

- Products

- Efficiency

- Technology

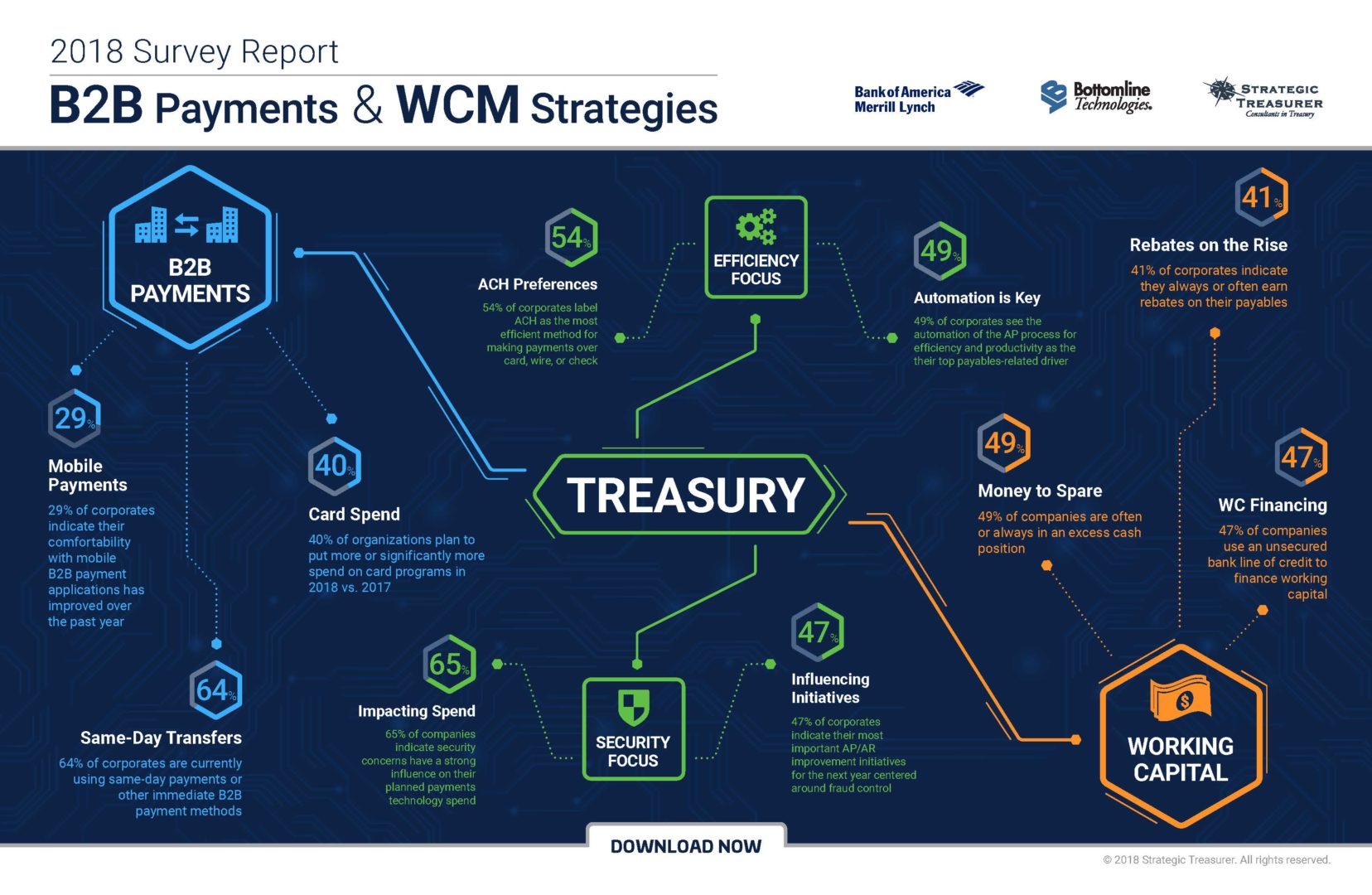

Key Findings

There was extensive data covered in this survey. Here is an overview of what we think was most interesting. If these pique your interest or you’re interested in seeing the data behind these findings, make sure to request the full report below.

B2B Payments Complexity and Spend

AP/AR Drivers: Security & Efficiency

Corporate Card Programs on the Rise

New Opportunities: Monetizing AP

Technology: Banks vs Corporates

Payment Types: Clear Winners & Losers

Access the Results Report

Thank you for your interest in our research. You will be sent a confirmation of your submission. Upon the release of the report, it will be sent to you via email.