Treasury Aggregators: An In-Depth Look

What is a Treasury Aggregator?

The term Treasury Aggregator may not be one with which most treasurers or financial professionals are familiar. The term is used to define the technology solutions that offer enhanced multibanking capabilities to clients for handling payments, reporting, and many other cash management and bank account management (BAM) functionalities. Strategic Treasurer defines a Treasury Aggregator as a solution that provides a single connection point to all of a corporate’s banking connections for both payments and reporting. A true Treasury Aggregator has established connections to a multitude of banks worldwide and is able to establish connections to any additional banks with whom a client has accounts, thereby giving clients access to any financial institution with which they do business.

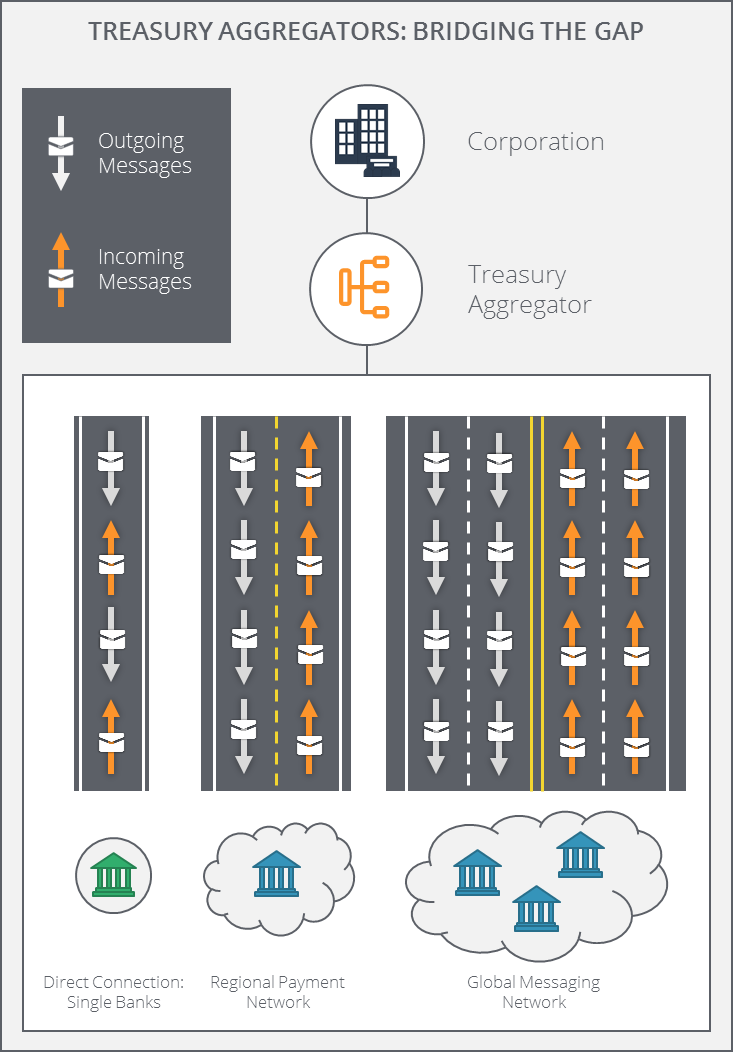

A Treasury Aggregator’s main function is to bridge the gap between a corporation and their banks. A helpful metaphor to consider when thinking about the role of a Treasury Aggregator is to think of the services that they provide as a road. In today’s world, roads allow for the efficient transportation of people and materials from one location to the next. Without roads, travel and communication between cities, states, and countries would be a much more difficult and complicated endeavor. By establishing the proper infrastructure and framework, people and materials all over the world can connect with one another safely and efficiently.

The same idea holds true for Treasury Aggregators. Just as establishing the proper infrastructure of roads facilitates communication and travel between cities, the construction of a robust connectivity framework allows for effective communication between a corporation and their banks. Treasury Aggregators play the role of the construction and maintenance crews in this regard, developing and maintaining the connections that will allow their clients to have instant access to banks all over the world, and ensuring that their communications occur seamlessly, securely, and without obstruction. The graphic below illustrates how Treasury Aggregators work to bridge the gap between a corporate client and their banks.

What is Driving the Need for Treasury Aggregation Technology?

Through numerous industry surveys and discussions with both corporate practitioners and financial technology vendors, Strategic Treasurer has identified three primary drivers that are resulting in a need for the services provided by Treasury Aggregators. These drivers are rapid economic globalization, a rapidly changing payments and financial messaging landscape, and evolving compliance and security expectations.

- Rapid Economic Globalization: Organizations operating in the modern business era are increasingly conducting their operations on a global scale. According to the Strategic Treasurer & Bottomline Technologies 2016 Treasury Fraud & Controls Survey, 73% of respondents were operating in more than one country. For these companies with business operations in multiple countries, the ability to deliver and exchange financial messages quickly and securely is a necessity.

- Evolving Payments Landscape: Since the 1970s, the dominant format used for exchanging financial messages has been the SWIFT MT (ISO 15022) format. This format is currently the most commonly used financial messaging format, with SWIFT being the driving force behind its widespread use. However, a newer format, ISO 20022, was introduced to the financial messaging landscape in 2004. The XML-based ISO 20022 structure is much more flexible and open in its design and is widely recognized as the message format of the future. This has led to a number of companies choosing to update their financial messaging processes. Beyond financial messaging, there are a number of bank networks to which many organizations need connectivity, such as SWIFT, EBICS in Europe, Bacs, and NACHA. On top of these, most organizations also maintain direct (H2H) connectivity to a select number of their banks. In order to help reduce complexity regarding their connectivity options, organizations are looking to Treasury Aggregators to establish and maintain all necessary connections on their behalf.

- Increased Compliance Expectations: The sheer volume of regulations that organizations are expected to abide by in the modern business era has resulted in a complicated and often frustrating compliance landscape. Regulations such as FBAR and FATCA as well as governing bodies such as OFAC have substantially increased the burden placed upon organizations regarding their compliance procedures. These procedures, if handled improperly or altogether avoided, can have severe consequences for the organizations at fault, including serious legal action and heavy fines. Treasury Aggregators assist in the compliance side of operations by conducting sanctions screening and data validation checks on all their clients’ incoming and outgoing financial messages. In many cases, Treasury Aggregators will also provide clients with tools for managing bank account information such as signers and balances, which helps with the FBAR filing process.

What Functions Does a Treasury Aggregator Perform?

Treasury Aggregators seek to perform the tasks and functions associated with the funds transfer and information reporting processes that occur between a corporation and their banks. While this might sound easy enough, there are a multitude of steps that must be completed for these processes to occur smoothly, such as sanctions filtering, data validation checks, security precautions, message format conversion, and finally, establishing connections to the appropriate banks.

- Funds Transfer Cycle: Treasury Aggregators begin the funds transfer process by taking in payment instructions from any department within an organization, such as payroll, accounts payable, and treasury. The payment instructions sent by each of these departments can be originated in the preferred format of the initiator, such as an MT101, EDI820, or pain001 message. The payments system provided by Treasury Aggregators allows clients to set up approval processes that can require dual signatories for payment initiation or that can generate alerts for payments that exceed a designated amount.

- After a payment has been approved, Treasury Aggregators will then screen and validate the message to ensure that it does not violate any known sanctions lists and that the information contained within the message is accurate and complete. During this process, any message that is flagged as errant will be sent to a resolution queue, and a notification will be sent to the client requesting further action. The Treasury Aggregator then reformats the message into the format required by the client’s bank. This can include converting MT messages into pain messages, pain messages into a bank-specific proprietary format, and vice versa. Finally, the Aggregator will deliver the message through the appropriate channel and to the required bank.

- Information Reporting Cycle: The steps that Treasury Aggregators perform to deliver balance reports and other information from banks to their corporate clients is very similar to the funds transfer cycle, only it occurs in the opposite direction. For information reporting, Treasury Aggregators receive reports sent by all of a client’s banks in the bank-originated format (MT940, BAI2, camt, etc.). After performing data validation checks on each message, they then convert the messages into the desired format of the corporate and deliver them to the end system (TMS, ERP, etc.). As with payments, Treasury Aggregators ensure that all balance reports and other reporting information delivered through their system remains secure.

- Additional Functionality: In addition to the funds transfer and information reporting cycles, Treasury Aggregators can provide other functionality related to cash positioning, forecasting, and bank account management. Once an Aggregator has connected a client to their banks and is facilitating the exchange of information, they are then able to provide real-time updates on cash positions and balances across all banks, bank accounts, subsidiaries/branches, and regions, which drastically increases visibility. Many Aggregators can also keep track of account information for clients, such as signers on accounts and bank documentation, and prepare reports on compliance activity as part of their Bank Account Management (eBAM) offering.

What are the Major Benefits Provided by Treasury Aggregators?

Organizations using a Treasury Aggregator are typically able to realize several key benefits. These benefits include increased visibility, enhanced centralization, automation, and overall greater control over their payments, reporting, and cash management processes.

- Increased Visibility: For Treasury, the implementation of a Treasury Aggregator often results in increased visibility across all their banks and accounts. One of the reasons for this stems from the ability of Treasury Aggregators to provide account information and balances in real-time, which gives treasury up-to-date and accurate information. Treasury Aggregators are generally able to deliver this information using a set of dashboards and interactive interface that allows for easy viewing and effective analysis of cash flows, balances, and positions. Visibility to accounts can be viewed across different banks, regions, currencies, and subsidiaries.

- Centralization of Company-Wide Payment Processes: One of the major benefits realized through the provision of payment hub services provided by Aggregators is treasury’s ability to view transactions that are occurring across every department of their organization. In many firms, Treasury uses a payments system that is separate from other departments, which causes a delay or gap between payments from AP and payroll being sent and treasury being notified. With a payment hub, treasury can view the payment requests and transactions occurring throughout their entire organization in real-time, which improves their ability to conduct cash forecasting and liquidity management operations and also gives them enhanced accuracy with regards to cash positioning.

- Enhanced Automation: Treasury Aggregators are able to increase the level of automation realized by organizations in their daily operations by providing streamlined and integrated workflows that use a single source of data. This is preferable, as it reduces the number of segmented processes that exist within treasury and allows for different functions to flow through one another, thus cutting down the level of manual intervention and labor required. For instance, a payment initiated by treasury that has been successfully delivered to a bank will automatically have a balance report generated for it, and the system will update the company’s cash position in real-time without requiring manual input.

- Greater Control: As a result of the above benefits that Aggregators provide, a cumulative benefit is that treasury gains greater control over their processes as a whole. The increase in visibility ensures that errors and inefficiencies, as well as possible fraudulent activity, can be quickly identified and handled. The centralization of payment processes results in more effective management and control of liquidity and cash positioning, and also reduces the threat of payment fraud by cutting down on the number of company-wide payment systems and system access points. Finally, the automated processes provided through the use of Aggregators reduce the workload on treasury for performing mundane tasks and free up time to focus on other areas of operation. These automated processes also help reduce the number of errors that can occur through manual labor.

Isaac Zaubi

Publications Manager, Treasury Analyst

Isaac Zaubi has been with Strategic Treasurer for over 2 years as a treasury analyst before coming into his current role as Publications Manager. Isaac’s contributions center primarily around the development and management of publications, including fintech analyst reports, survey results reports, e-books, and whitepapers.