2016 FBAR & BAM Update

Blog Series: FBAR (Foreign Bank Account Report)

Sign-Up Below To Have Them Delivered

As FBAR deadlines have shifted yet another year, we have to stay aware of requirements and pending changes and track how they might impact corporates. The current deadline for individual FBARs with signature authority over but no financial interest in accounts is April 15th, 2017. These types of filers are typically signers on employer’s foreign accounts and have no personal control over being added or removed from accounts. It is common for a company to leave an individual as a signer on bank accounts even after they have left the company. It is often a burden for an already overtasked treasury team to do a full signer audit year after year. Sometimes they may perform a complete audit, but a breakdown may occur and the bank does not actually remove the signers as requested.

Regardless of the circumstances, we evaluate any signers authorized with a corporation’s banks at any given point during the filing year and encourage all individuals listed to file an FBAR – even if they are a former employee. In such a circumstance, it can be helpful for a third party filer to handle that company’s FBAR. This allows the company to continue with their daily operations and for the third party to handle all documentation and tracking of current and former employees necessary for the respective filing year or years.

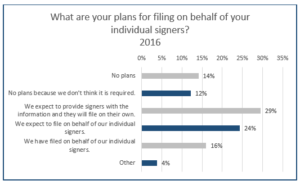

Strategic Treasurer has conducted its annual FBAR & Bank Account Management Survey since 2014 in order to understand what corporates are doing with these regulations at the company and individual level. This year’s survey involved record breaking numbers of participants, both domestic and international. As seen in the next graph, 40% of 2016’s participants expect to file or have filed on behalf of their individual signers as a company.

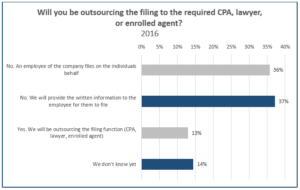

13% of respondents have confirmed they will be outsourcing the FBAR filing to a 3rd party in order to complete the necessary electronic filing. An almost even split of participants will file internally for employees or simply provide them the information in order to file. Depending on your number of signers on foreign accounts, it might make sense for the company to handle FBAR filing internally. A larger number such as 20+ signers might trigger the need for help from an outside company. Your corporation should take their own culture, staff availability, and number of signers on foreign accounts into consideration when deciding between filing on behalf of individuals or outsourcing the task.

Click HERE to see how Strategic Treasurer can help you with your Individual FBARs.

Additionally, follow Strategic Treasurer on Twitter and LinkedIn to stay up-to-date with all FBAR filing updates. You can also join the discussion in our FBAR group here.

See the rest of the topics we’re covering and learn more with our FBAR & BAM Compliance Blog Series here.