FBAR (Foreign Bank Account Report): The What and Why

How are your Peers doing?

On March 31st, we held our 2016 FBAR & BAM Survey Results Webinar. This article previews a few of the survey findings ahead of time.

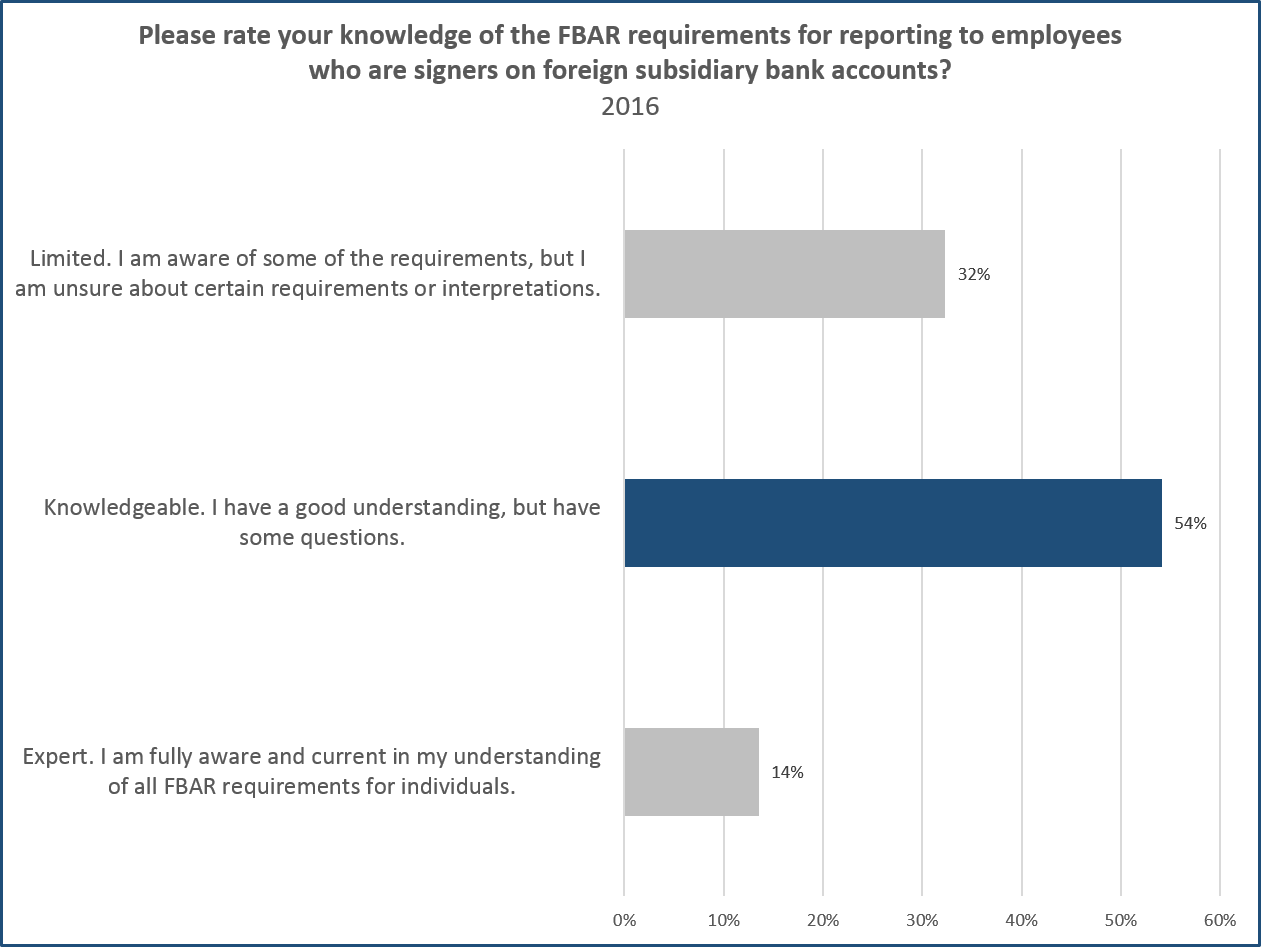

Below, we show how participants self-rated their grasp of the FBAR requirements. Nearly 1 in 3 (32%) fall into the category of limited knowledge and only 1 in 7 (14%) consider themselves experts. We frequently speak to corporates about their interpretations of the FBAR language and requirements therein, and while most are quite aware of the corporate filing requirements in detail, it is common to have quite a few questions about individual signers who may or may not need to file.

*Data from 2016 Strategic Treasurer FBAR & BAM Survey.

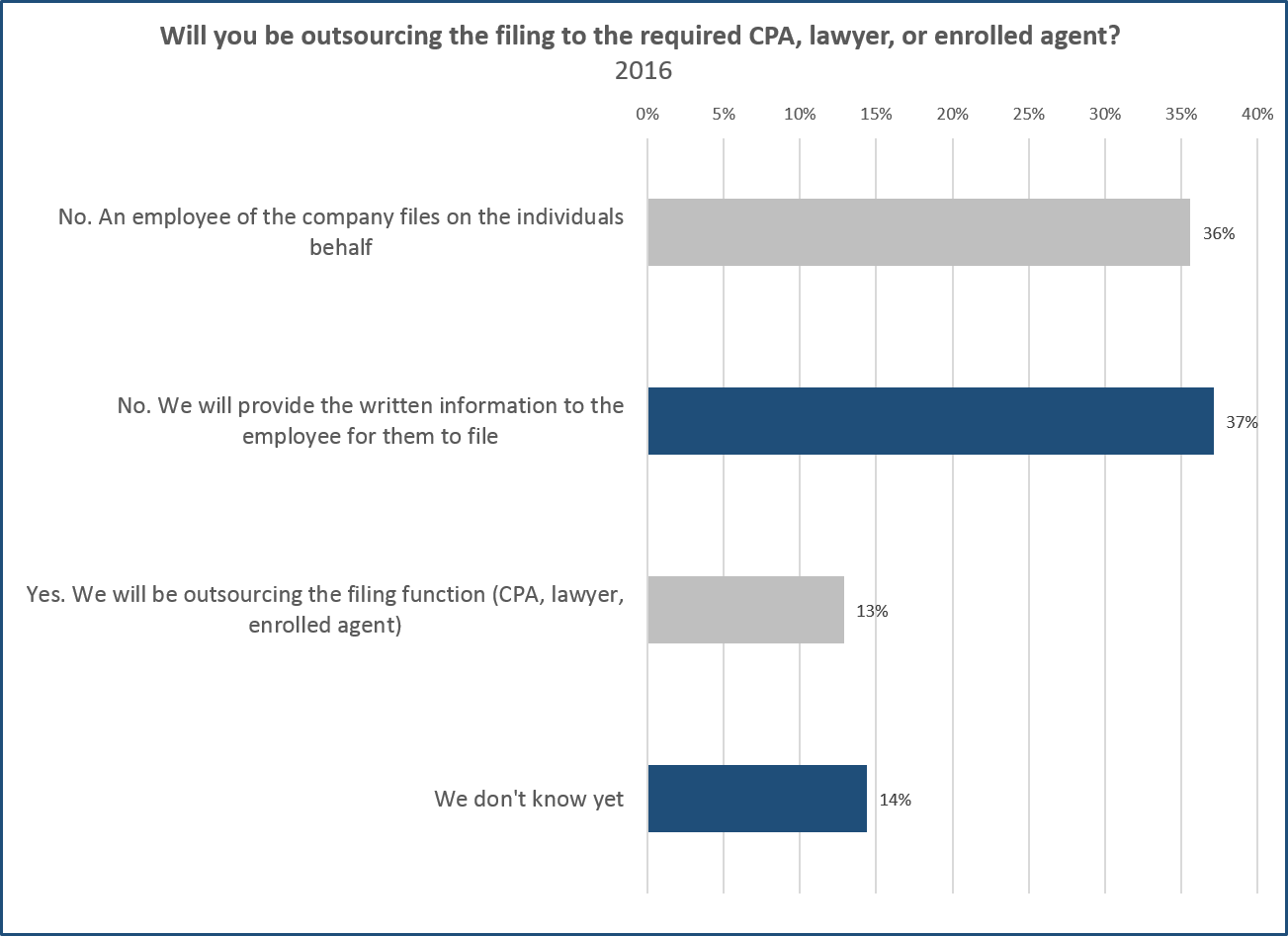

*Data from 2016 Strategic Treasurer FBAR & BAM Survey.

While not even a quarter of respondents feel like a FBAR expert, we might expect that many corporations would seek outside assistance to file or even outsourcing the entire process. Yet, only 13% intend, at this point, to outsource the filing process. We weren’t specific on whether this only covered corporate filings or individual filings.

Given the general confusion of filing and the requirement to file electronically, many organizations may want to seriously consider outsourcing to a third party filer for at least the individual filing steps (requirements for 3rd party filers (lawyer, CPA or other enrolled agent). This removes some of the confusion and risk of handling the individual FBARs internally.

How are you handling your FBAR filing as an individual? How is your company handling the filing for individuals? These are questions you should be asking and answering now if you have US signers on foreign bank accounts.

FBAR’s Impact is Real

(Contributed to by Michael Uram, Chesapeake System Solutions)

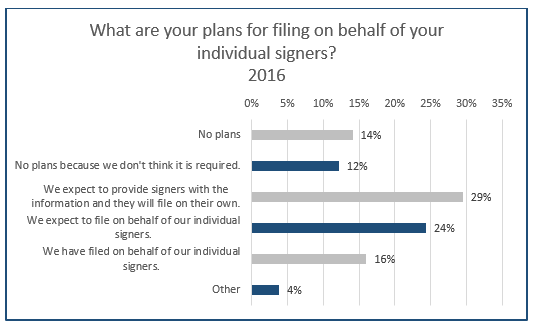

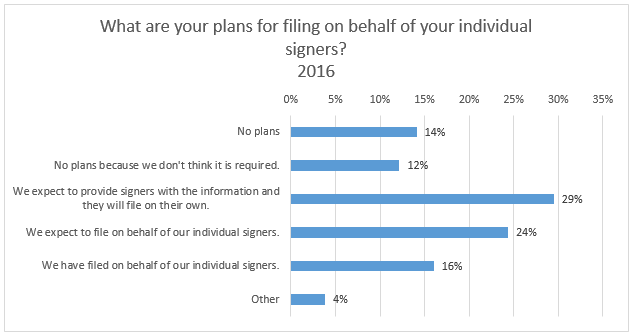

Simply put, a US person authorized to input or approve financial transactions on foreign accounts who fails to report to FINCEN can get themselves or their business into big trouble. Yet in early 2016, only some 40% percent of firms had filed or expected to file on behalf of their individual signers.

*Data from 2016 Strategic Treasurer FBAR & BAM Survey.

By April 15, 2017, even individuals without financial interest in a foreign bank account must electronically file an FBAR for 2010–2016, and their employing company must provide them the information to do so.

Why should your organization care?

Imagine accumulating and compiling five years’ worth of historical information while trying to perform your day job. This mandate will certainly pose significant organizational challenges. Companies will need to document all of their foreign accounts, when they were opened and closed, who had signatory authority over them and for what period of time, as well as exact balances. Willful violations could result in fines of $100,000 or 50% of the account; non-willful violations could result in a $10,000 fine. Any criminal intent associated with the failure to file an FBAR will result in up to $250,000 in fines, 5 years in prison, or both.

The Silver Lining

Foreign Bank Account Reporting (FBAR) Provides a Window into Bank Account Management (BAM) Problems.

It is easy to get miffed or put out by regulations. FBAR is one such regulation that gets people hot under the collar especially when they aren’t procrastinating the work required to support the individual filings. However, few of us treasury types recognize the silver lining in this regulation.

The requirements for filing FBAR for corporations (the corporate filing and the individual filing for those signers who have no financial interest in the accounts) are quite involved and bureaucratic. But, they point out weaknesses in how our organizations manage their bank accounts (including signers, control services, etc.).

Here are just a few:

- If you have to file for signers who had signing authority at any point during the year –then your BAM process must keep track of the start and stop authority for each signer.

- Only 40%* of firms indicate they have that capability in their BAM process today.

- Since the language of the law/regulation equates ‘System Signers’ with traditional bank signers, this means your BAM process must keep track of those who can instruct the bank to move funds. This certainly represents an exposure to your organization and should be tracked religiously.

- Only 18%* of firms indicate they have that capability in their BAM system/process today

Every bank account represents a point of expense & exposure.

Every bank account represents a point of expense and exposure. Managing bank accounts is important, even if considered non-urgent. In addition, the AFP summarized 5 Key Takeaways from our joint FBAR Session at Texpo with Axletree Solutions (http://bit.ly/AFP_FBAR) and contains what we consider to be relevant and specific prescriptive advice (#2 get a BAM system if you have more than 6 banks and 100 bank accounts). Most of these tips will benefit every organization even if FBAR didn’t exist (except #1 which is Don’t Delay in Filing for Individual FBAR).

Maybe it is helpful to try and find some silver linings the next time regulations are getting you down.

The Implications of Not Filing an FBAR

What if I don’t file my FBAR?

This question can be answered by first placing yourself into one of two categories. If you KNOW you need to file an FBAR, and negligently or willingly choose to skip filing, your potential consequences are much worse than if you non-willfully violate filing requirements. If a person willingly fails to file an FBAR, they can be imposed with a civil monetary penalty of $100,000 or 50% of the balance – whichever amount is greater. It is also possible to be subject to criminal penalties in this instance.

If the FBAR is not properly filed, the person may be subject to a civil penalty no greater than $10,000 per violation. If a reasonable cause exists for the failure, and the account balance in the FBAR is reported correctly, no penalty will be incurred.

A delinquent FBAR can be filed with the reason for filing late listed within the electronic format.

Valid reasons for late filing include:

- Forgot to file

- Did not know I had to file

- Thought Account Balance was below reporting threshold

- Did not know account was foreign

- Account statement lost or not received in time

- Individual was late in receiving missing required account information

- Unable to obtain joint spouse signature in time.

If the IRS decides that the FBAR was not filed late due to negligence, but with reasonable cause, no penalties will be imposed.

Why File on Behalf of Your Individuals?

40% of corporations plan to file or have chosen to file on behalf of individuals with signatory authority over but no financial interest in foreign accounts (Strategic Treasurer 2016 Compliance Survey FBAR & BAM).

It is not mandatory for corporations to do so, but there are valid reasons for them to be taking interest in such a filing arrangement – whether they complete the filing in-house or hire a third party filer. In the event that an employee completes their own individual filing, the IRS does not give a clear definition of exactly what is owed to them by the company.

The requirements for acceptable input with regard to BSA e-filing ARE clear. Filers must have bank account information including full account numbers, balances, as well as entity TIN numbers. These are not difficult to access in-house, but what if a former employee is filing for previous years they were employed at the company? Through the guidance sheet released in 2011 (found here), it is made clear that FinCEN does not expect former employees to be given proprietary and confidential information from the former employer. They also clearly state it is not the duty of the employee to personally maintain the records of the company’s bank account information for purposes of FBAR filing. The gray area lies in exactly what the employer is required to provide to the employee in order to file. Entries such as “NA”, “Unknown”, or “XX” are not acceptable fields when filing an electronic FBAR, although the actual account balance can be reported as “N/A or Unknown”.

Essentially, the employer has a responsibility to provide at least minimal information to the employee, and the employee must show due diligence in filing as properly as they can. An easy way to avoid this imbalance would be for the company to file on behalf of the employees, or have a secure third party filer complete their FBARs. In this way, information can be contained securely and efficiently to ensure all parties complete their obligation.

*Data from 2016 Strategic Treasurer FBAR & BAM Survey.

Katelyn Gibbs

Compliance Manager, Strategic Treasurer

Katelyn Gibbs is a compliance lead with Strategic Treasurer and has assisted clients with FBAR filing activities since joining the firm in 2013. She manages the group’s analysis activities and performs compliance and discrete filing. By managing the status of each individual’s filing throughout the entire process, she stays completely familiar with and up to date on the various requirements and FinCen updates for individual filing and filers.

Craig Jeffery

Managing Partner, Strategic Treasurer

Michael Uram

Product Manager, SmartTreasury Chesapeake System Solutions