Mars and Venus. How finance folks can speak the same words but mean something very different. To be a successful treasurer or treasury professional, it really helps to understand these issues of equivocation (meaning same words with different meaning). Let’s start with our first example:

CASH. What a simple word. Let’s look at some differences:

The controller is concerned about cash from a GAAP perspective. You know, accounting 101. The first accounting entry you learned was from issuing a check. The debit and credit went something like:

DR. Accounts Payable $57.50

CR. Cash $57.50

This entry relieved (reduced) the Accounts Payable liability. Cash was decreased. And, life is good. That is GAAP. If, before that great event where you cut the check, you had $10,000 in cash on your books (AKA the General Ledger or GL) your balance would be $9,942.50 and life is good. But, what happens when the check clears 8 days later? The accountant says ‘nothing’, we already recorded the entry to cash – and checks clear quickly as a matter of course.

The treasurer is concerned about cash from a LIQUIDITY perspective.

You know the old joke, I can’t be out of money, I still have checks? Well, the treasurer says “debits, schmebits (sorry if I spelled that incorrectly) my bank says I have funds available to use – I’m using them. Good stewardship requires that of me. Also, on the other side of the equation, just because you record a deposit – that doesn’t put usable funds into your bank account instantaneously. Accounting would say we have a higher balance than the bank will let us use since banks say they are “not in the business of lending money without some form of compensation”. Which is simply a nice way of saying that they won’t let you overdraw your account because accounting talks about GAAP so much. And, when the gloves are off you might hear that age old treasurer to controller taunt of “hey, you’re not making an entry when the check clears? That seems very unbalanced of you.” (Controllers can’t stand that taunt).

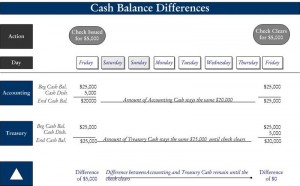

The nearby graphic shows a simple comparison of how a controller and a treasurer will view their cash balance. The difference in their views of cash remain (with one simple check) for about a week. Magnify this by thousands of checks and hundreds of deposits… Well, who is right in their treatment – the treasurer or the controller? That it not the correct question. The correct question is how can we simply comply with GAAP (okay, that is important) and support the organizational need to be good stewards of their funds.

There are several great ways of handling this with grace. In an era of automation – the excuses NOT to manage this effectively are erased. We will cover at least one method for gracefully handling these differences in another blog or in a primer on our website. -c