Major Market Conditions Impacting Supply Chain Finance

This article was originally posted in the Treasury Update Newsletter (Quarter 2, Summer 2018). You can see the full newsletter here.

Introduction

The financial supply chain can be a fragile and challenging area of operations. This is especially true in today’s dynamic and fast-paced business environment. In a global economy, events occurring in one region can quickly impact the daily operations of companies worldwide. And if organizations are unprepared for sudden changes, supply shortages and working capital

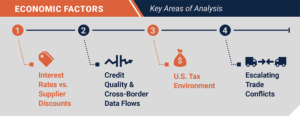

deficiencies can wreak havoc internally. For this reason, financial risk management, cash forecasting, and working capital optimization have become increasingly important responsibilities for treasury professionals today. As the owners of working capital, treasurers must constantly be surveying the landscape for any issues that might disrupt cash flows, while also  identifying opportunities that could enhance liquidity. While these cash management responsibilities require visibility to a variety of areas, the financial supply chain takes on particular importance. As the benefits of streamlining cash conversion cycles and optimizing payment strategies with vendors becomes more apparent, buyers and suppliers alike are turning to their financial supply chain to achieve greater efficiency and, ultimately, to get a better handle on their working capital. However, as these initiatives are pursued, new market and economic factors continue to alter the landscape. Thus, as firms look to implement supply chain finance initiatives, it is vitally important that they understand how potential market events could alter the profitability and viability of their programs. Looking at 2018 and 2019, we have identified four key economic factors that are currently impacting or could impact firms’ supply chain finance initiatives, for better or for worse. These include rising interest rates, a new U.S. tax structure, looming trade conflicts, and challenging cross-border regulatory policies. Each of these factors and their effects on the realm of supply chain finance are analyzed further in the following pages.

identifying opportunities that could enhance liquidity. While these cash management responsibilities require visibility to a variety of areas, the financial supply chain takes on particular importance. As the benefits of streamlining cash conversion cycles and optimizing payment strategies with vendors becomes more apparent, buyers and suppliers alike are turning to their financial supply chain to achieve greater efficiency and, ultimately, to get a better handle on their working capital. However, as these initiatives are pursued, new market and economic factors continue to alter the landscape. Thus, as firms look to implement supply chain finance initiatives, it is vitally important that they understand how potential market events could alter the profitability and viability of their programs. Looking at 2018 and 2019, we have identified four key economic factors that are currently impacting or could impact firms’ supply chain finance initiatives, for better or for worse. These include rising interest rates, a new U.S. tax structure, looming trade conflicts, and challenging cross-border regulatory policies. Each of these factors and their effects on the realm of supply chain finance are analyzed further in the following pages.

“As the owners of working capital, treasurers must constantly be surveying the landscape for any issues that might disrupt cash flows, while also identifying opportunities that could enhance liquidity.”

Interest Rates

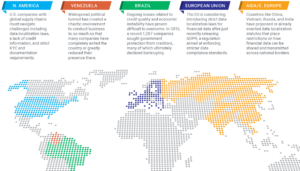

When determining the most effective strategy for optimizing working capital, the interest rate environment is one of the first factors that comes into play. As virtually all of the investments financed by working capital are of shorter duration, available investment opportunities must be closely evaluated alongside any supplier discount programs and debt repayment options to determine which avenue is most cost-effective. In a low interest rate environment, many organizations discover that the discounts offered by some suppliers in exchange for early payment will far surpass the returns of any short-term investment. As these discounts are also considered to be a near risk-free form of return, many companies find such programs highly effective, especially in low-interest rate environments. However, as interest rates rise, the comparative benefits of supplier discounts will dissolve and it may become more effective for buyers to forego the discount and instead look to maximize returns in the market. Looking at North America specifically, interest rates have continued to rise quickly and currently stand at 2%. What’s more, a recent Strategic Treasurer survey found that 90% of corporates expect U.S. interest rates to continue increasing over the next 12 months* . While there are other factors that influence a company’s working capital strategies, there is typically a greater level of participation in discounting programs in low interest rate environments than in high-rate environments. However, it is worth noting that the annualized return achieved through a standard 2/10 net 30 discount is over 36%. Comparatively, the nominal yield for a 30-day AA asset-backed commercial paper  issue is ~2% at the time of this writing in June 2018**. Other options, such as investing cash internally or paying down debt, are also potential strategies. However, even these options will rarely, if ever, exceed the 36% annual returns obtainable through supplier discounts. And given that 50% of corporates indicate that they are often or always in an excess cash position***, many treasurers find they are in a satisfactory liquidity position to quickly pay suppliers without having to use 3rd party funds or borrow cash. Thus, supplier discounts are one of the most effective forms of return on working capital, and any organization not currently utilizing supplier discounts would be wise to evaluate how such a program could impact their cash flows.

issue is ~2% at the time of this writing in June 2018**. Other options, such as investing cash internally or paying down debt, are also potential strategies. However, even these options will rarely, if ever, exceed the 36% annual returns obtainable through supplier discounts. And given that 50% of corporates indicate that they are often or always in an excess cash position***, many treasurers find they are in a satisfactory liquidity position to quickly pay suppliers without having to use 3rd party funds or borrow cash. Thus, supplier discounts are one of the most effective forms of return on working capital, and any organization not currently utilizing supplier discounts would be wise to evaluate how such a program could impact their cash flows.

Regulatory Challenges: Credit Quality & Cross-Border Data Flows

Today, the varying sets of regulations in play across the world means that any buyer with a globally distributed supply chain must comply with a multitude of legal frameworks and scenarios. This dilemma is particularly problematic in South America and Asia, where regulations can be quite different from one country to the next and it is very challenging to develop a standard set of supplier financing procedures. For instance, the ongoing lack of any robust credit structure in many South American countries makes it very difficult to determine the creditworthiness of suppliers. At the same time, widespread economic turmoil in the region has deterred foreign investment, and in 2015, a record 1,287 Brazilian companies sought government protection from creditors****. Thus, many companies find that the risk of supplier default or economic instability in this region poses too great a risk to invest significant amounts of time or money in a supplier financing program. However, in recent years, a broader issue being experienced by firms looking to implement a global SCF program involves data protection and privacy policies currently in place or being proposed by the governments of China, Russia, Brazil, India, and Vietnam. In these countries and even recently within the EU, new and proposed data localization policies have placed limitations on how a wide range of information, including financial data, can be transmitted and shared cross-border. In some instances, countries have made it virtually illegal to transmit financial data from local businesses across national borders unless strict requirements and approvals are met. Where supply chain finance is concerned, this means that an organization that uses a global electronic solution for supply chain finance would have to comply with all  sorts of checks and inspections and may even be required to maintain local data servers in each country where financial data is being pulled or extracted. This would introduce an entirely new set of expenses for companies and have a profound impact on the cost effectiveness of their programs. In order to limit the effect that these rules would have on their business, many cloud-based SCF solutions providers hold that while they must maintain physical servers in each country of operation, each individual business that operates on their platform does not. This means that a business using a SCF solution that maintains local servers in China and India would not have to maintain their own separate servers in the region in order to extract financial data from their suppliers. However, given the complex and ever-evolving nature of these laws and regulations, organizations looking to implement a cross-border supplier financing program are strongly encouraged to consult with their legal teams and other experts to ensure compliance.

sorts of checks and inspections and may even be required to maintain local data servers in each country where financial data is being pulled or extracted. This would introduce an entirely new set of expenses for companies and have a profound impact on the cost effectiveness of their programs. In order to limit the effect that these rules would have on their business, many cloud-based SCF solutions providers hold that while they must maintain physical servers in each country of operation, each individual business that operates on their platform does not. This means that a business using a SCF solution that maintains local servers in China and India would not have to maintain their own separate servers in the region in order to extract financial data from their suppliers. However, given the complex and ever-evolving nature of these laws and regulations, organizations looking to implement a cross-border supplier financing program are strongly encouraged to consult with their legal teams and other experts to ensure compliance.

Tax Environment

In late 2017, the first overhaul to the U.S. tax structure in over thirty years was passed by congress, which introduced widespread tax cuts for both businesses and individuals. Regarding corporate taxes specifically, rates were reduced from 35% to 21%. While these changes look to provide advantages for all U.S.-based companies, those with overseas operations stand to benefit most. This is due to an additional measure of the reform that allowed a temporary reduction to the repatriation tax, which has stood at 35% over many years and has been a massive barrier for firms looking to bring money back into the United States. The repatriation tax (a tax on foreign holdings that U.S. companies must pay in order to return or “repatriate” their funds back to the U.S.) was cut by as much as 50% in early 2018 as part of a tax holiday. Because of this cut, companies brought tens of billions of dollars back into the United States, which has served to further domestic investments in a wide range of areas including supply chain finance.

In a recent survey conducted by Strategic Treasurer and TD Bank, 42% of corporates saw U.S. tax reform as presenting an  opportunity for their business, and over 25% indicated that they would bring funds back to the U.S. as a direct result of the reform*****. And as we have seen, U.S.-centric investments did jump considerably and billions of dollars were repatriated back into America from overseas stockpiles. As a result of this influx of capital, corporates now have more cash to invest in new projects and initiatives, with data indicating that updates to financial technology will see specific focus and attention. Regarding these tech-focused investments, 14% of organizations planned to invest in supply chain finance solutions over the next year; nearly one in seven firms! Additionally, 34% of firms indicated an intent to spend on faster and more integrated AP and AR capabilities, which closely coincide with supply chain finance programs and would also serve to bolster working capital initiatives******.

opportunity for their business, and over 25% indicated that they would bring funds back to the U.S. as a direct result of the reform*****. And as we have seen, U.S.-centric investments did jump considerably and billions of dollars were repatriated back into America from overseas stockpiles. As a result of this influx of capital, corporates now have more cash to invest in new projects and initiatives, with data indicating that updates to financial technology will see specific focus and attention. Regarding these tech-focused investments, 14% of organizations planned to invest in supply chain finance solutions over the next year; nearly one in seven firms! Additionally, 34% of firms indicated an intent to spend on faster and more integrated AP and AR capabilities, which closely coincide with supply chain finance programs and would also serve to bolster working capital initiatives******.

Trade Conflicts

While the U.S. tax cuts look to boost the U.S. economy, there are several other developments facing the landscape with impacts that have yet to be fully determined. Where supply chain finance is concerned, perhaps the most relevant issues have to do with escalating trade conflicts. These include discussions regarding the Trans-Pacific Partnership (TPP), the renegotiation attempts of the NAFTA trade deal, and also the rapidly escalating trade conflicts between the U.S., China, and other G-7 nations concerning trade imbalances.

Regarding the North American Free Trade Agreement (NAFTA), Canada, Mexico, and the United States are currently locked in discussions on how to reconstruct the deal and talks are scheduled to last throughout the summer. Currently, representatives from each country are operating with the hope that new terms for the agreement can be reached that are satisfactory for all parties. However, the U.S. recently imposed new tariffs on select Canadian and Mexican imports, and both Mexico and Canada responded with tariffs of their own. If further negotiations are unsuccessful, the termination of NAFTA could result in even more tariffs being levied on imports between the countries and disrupt the flow of commerce between business partners across North America.

Looking beyond NAFTA, perhaps an even more serious development concerning global markets is the rapidly escalating trade conflicts between North America, the other G-7 nations, and China. Over the past several months, friction between all of these countries has escalated as  the U.S. has introduced new tariffs on imported goods, claiming that current trade imbalances are stacked against them. In response, many of these nations have responded with tariffs of their own. While the direction these conflicts will ultimately take is not yet apparent, any trade war between the U.S. and the other G-7 nations or with China could be highly disruptive for multinational companies, with higher tariffs and the potential for a complete shutdown of trade all possible outcomes. If worse comes to worst, companies with global supply chains would be forced to alter their business networks to consist of primarily domestic companies, or face heavy tariffs and the potential for widespread supply shortages and blackouts.

the U.S. has introduced new tariffs on imported goods, claiming that current trade imbalances are stacked against them. In response, many of these nations have responded with tariffs of their own. While the direction these conflicts will ultimately take is not yet apparent, any trade war between the U.S. and the other G-7 nations or with China could be highly disruptive for multinational companies, with higher tariffs and the potential for a complete shutdown of trade all possible outcomes. If worse comes to worst, companies with global supply chains would be forced to alter their business networks to consist of primarily domestic companies, or face heavy tariffs and the potential for widespread supply shortages and blackouts.

FINAL THOUGHTS & To Learn More…

Due to the ever-changing nature of today’s global economy, companies cannot grow complacent with their supply chains. In an environment where working capital optimization and efficiency are heavily emphasized, treasurers are recognizing just how important a well-groomed and strategically managed supply chain is to their liquidity management initiatives. But developing and maintaining an optimized financial supply chain is easier said than done. In addition to the issues discussed above, any firm wishing to optimize their supply chain operations must also evaluate available funding sources, identify which type of technology solution should be leveraged, and also decide what techniques should be used to drive supplier engagement. Due to the complexities that can arise as such a program is created, the decision to develop a SCF program is one that requires careful and strategic planning. For organizations wishing to learn more about how to implement a technology-driven SCF program, click on the link below to sign up for our soon-to-be-released 2018 Supply Chain Finance Analyst Report. This year’s report offers a comprehensive view of the leading practices, strategies, and technologies utilized within the supply chain finance landscape today and also provides analysis on some of the top SCF vendors that currently operate within the space.

Footnotes:

Graphs 1-5: Treasury Update Newsletter.

* Strategic Treasurer & TD Bank Treasury Perspectives Survey. Download the full report here.

** Board of Governors of the Federal Reserve System, Commercial Paper Rates & Outstanding Summary. Derived from data supplied by The Depository Trust & Clearing Corporation. 15 June 2018

*** 2018 Strategic Treasurer, Bottomline, & Bank of America Merrill Lynch B2B Payments & WCM Strategies Survey. Download the full report here.

**** Tatiana Bautzer and Guillermo Parra-Bernal, Reuters, “Insight— Brazil a bright spot for debt restructuring advisors as recession bites hard,” Jan. 28, 2016

***** Strategic Treasurer & TD Bank Treasury Perspectives Survey. Download the full report here.

****** Strategic Treasurer & TD Bank Treasury Perspectives Survey. Download the full report here.

Isaac Zaubi

Publications Manager, Treasury Analyst

Isaac Zaubi has been with Strategic Treasurer for over 2 years as a treasury analyst before coming into his current role as Publications Manager. Isaac’s contributions center primarily around the development and management of publications, including fintech analyst reports, survey results reports, e-books, and whitepapers.