Webinar: Protecting Cashflow: How to Stop Late Payments Before They Start | January 22

This webinar will examine why overdue receivables are no longer just a downstream collections issue but an early warning signal of broader payment risk.

This webinar will examine why overdue receivables are no longer just a downstream collections issue but an early warning signal of broader payment risk.

Efficient cash application and collections processes are essential to maintaining a strong liquidity position, yet manual processes often delay visibility and distort forecasts. This session will explore how automation and data-driven AR workflows can accelerate cash conversion, enhance forecasting accuracy, and improve real-time visibility into usable cash. Learn how integrating AR and treasury data enables real-time liquidity insights and supports a unified approach to working capital management.

This webinar will explore how AI-powered tools can unlock receivables and strengthen working capital. Attendees will learn how automation can drive more predictable cash flows, lower days sales outstanding (DSO), and reduce bad debt through improved credit and collections practices. The session will also highlight strategies for evaluating solutions to ensure they align with organizational needs and support long-term scalability.

Accounts payable (AP) and accounts receivable (AR) processes are critical drivers of working capital efficiency. During this webinar discover how AI-driven automation streamlines manual AP and AR tasks with greater speed and accuracy, eliminates data silos, and enhances visibility for smarter cash management decisions. Learn why end-to-end automation is fundamental for improving liquidity management. You and your treasury team will be equipped to make more strategic decisions with reliable, real-time data, for better financial results and by freeing up staff to focus on higher value activities.

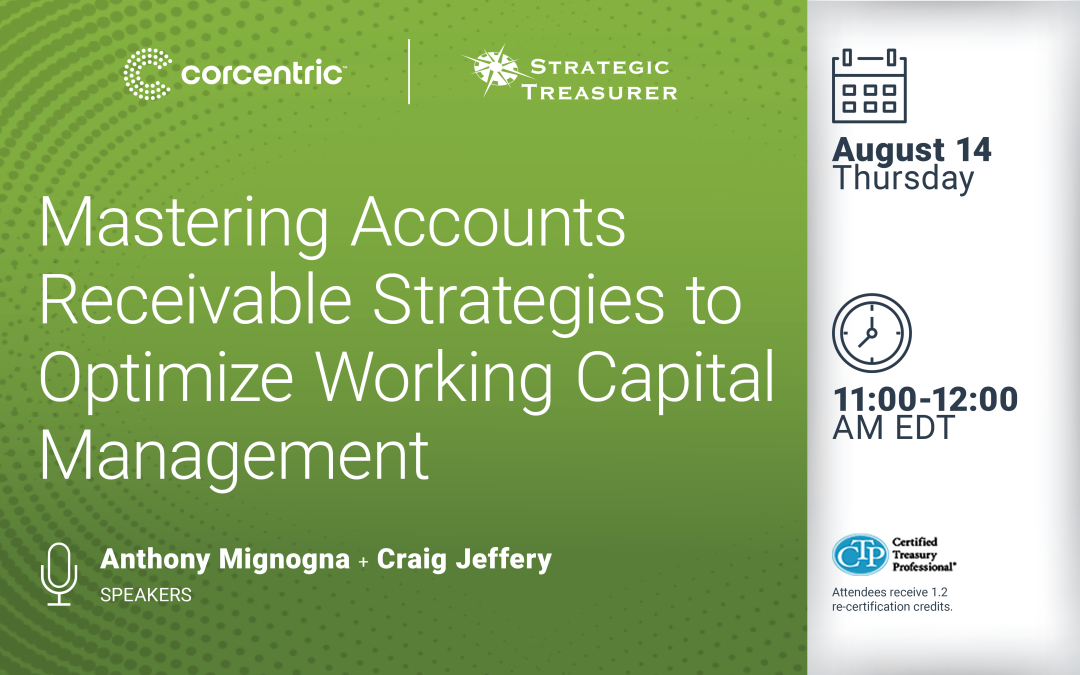

Discover how effective accounts receivable (AR) practices can drive working capital optimization. This webinar explores various strategies to improve cash flow, reduce payment latency issues, turn cash over quickly, and strengthen financial control. Learn how AR management can support broader organizational goals for efficiency and sustainable growth.