#400 – Payment Scamming: Exploitation and Defense (Eftsure)

In this episode, Craig Jeffery speaks with Ramesh Menon of Eftsure about the industrialization of payment fraud.

In this episode, Craig Jeffery speaks with Ramesh Menon of Eftsure about the industrialization of payment fraud.

Craig Jeffery talks with Paul McMeekin of Bottomline about the latest Treasury Fraud & Controls Survey findings and what they reveal about today’s threat landscape. From AI-generated fraud and deepfakes to payment rail changes and rising losses among small businesses, this episode covers practical defenses for a fast-evolving fraud environment.

The cost of fraud for banks and credit unions continues to rise, with every $1 lost resulting in nearly $6 in total costs once compliance, operations, and customer trust are factored in. In this interview, Jeff Scott with Q2 will explore how banks can address this growing challenge by shifting from fragmented, reactive defenses to a proactive “Fraud Intelligence” approach. He will discuss how data-driven insights, automation, and integration can reduce inefficiencies, cut the true cost of fraud, and strengthen both protection and customer experience.

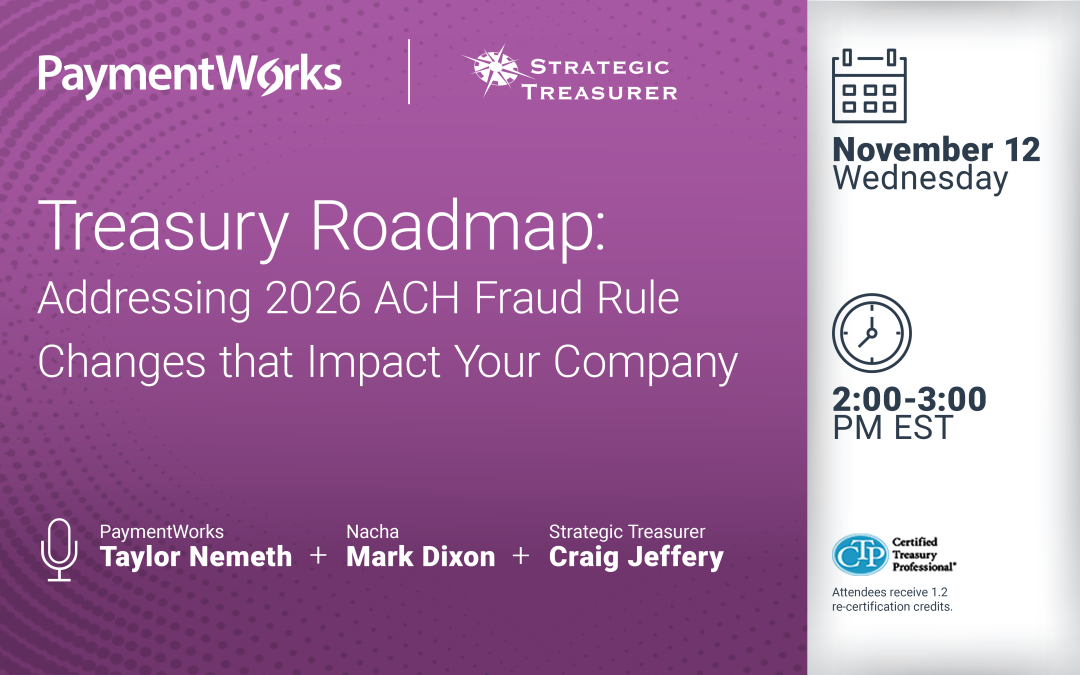

Treasury leaders are at the heart of every organization’s banking relationship, and now sweeping new rules for ACH “push payments” are putting the treasury front and center in the fight against fraud.

Effective June 2026, every company and public sector organization must comply with these changes, designed to reduce fraud and improve fund recovery in cases of business email compromise and vendor impersonation scams. For treasury teams, the stakes are high: these rules directly impact how your organization manages supplier onboarding, payment change requests, and ACH payments.

Join PaymentWorks, Strategic Treasurer, and Nacha for an exclusive session tailored to treasury leaders. You’ll gain practical insights into what these changes mean for your team, your processes, and your banking relationships.