#365 – Leading Practices in Treasury: Compliance and Leveraging Networks

In this episode, Paul Galloway joins Pushpendra Mehta to explore compliance and network optimization in treasury.

In this episode, Paul Galloway joins Pushpendra Mehta to explore compliance and network optimization in treasury.

As payment methods diversify and customer expectations increase, the traditional collection and lockbox processing model must evolve. Deluxe’s Dave Boyce sits down with Craig Jeffery on the Treasury Update Podcast to talk about the latest capabilities lockbox providers can use to improve their existing processes and meet the growing needs of corporations.

In this episode, Craig Jeffery talks with Dave Robertson about how AI is being applied in treasury today. They cover key use cases, from forecasting and credit analysis to policy automation, and explore challenges like hallucinations and data privacy. What should treasurers be doing now to prepare for what’s coming? Listen in to learn more.

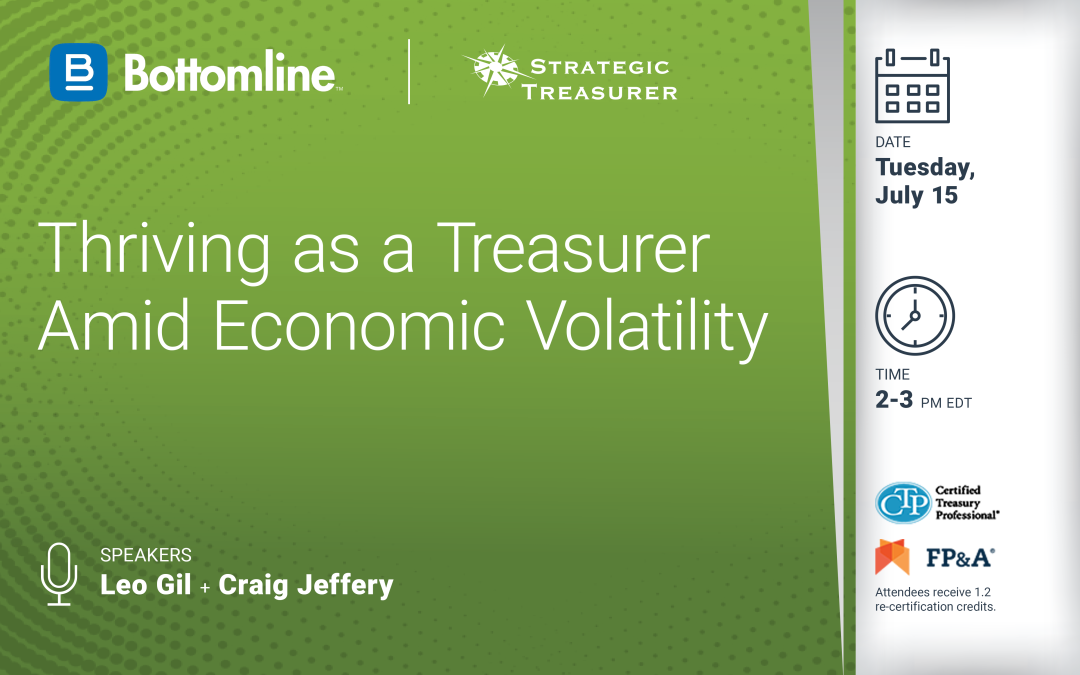

In a world shaped by central bank decisions, labor market shifts, and evolving trade dynamics, businesses are facing increasing volatility. While the future remains uncertain, standing still is not an option. How can treasury teams rise to the occasion? Join this webinar to explore practical insights and strategies that empower treasury professionals to adapt, stay effective, and support their organizations through turbulent times.

Pushpendra Mehta and Paul Galloway discuss how a comprehensive process mindset helps treasury deliver strategic value and improve efficiency across the organization.