Treasury has an ever-increasing list of challenges they face. Some of these challenges are driven internally and some are compliance related, but the biggest challenge is often the heightened expectations of what treasury needs to accomplish with a reduced staff. If we look at the numbers from a recent survey, 68% of smaller organizations are currently working with a treasury staff of three or fewer. 27% of larger organizations are working with a staff of four to six. In addition, 62% of respondents in a recent survey responded that their staffing level has stayed the same over the last year. As companies become more global and complex, treasury remains understaffed, struggling to perform their work responsibilities.

This situation is leading many organizations to turn to treasury technology. TMS solutions are providing more functionality at a lower cost. By simplifying and automating workflows, the gains in operational efficiency lead to a more strategic focus. With a TMS, treasury teams are often more able to be proactive rather than reactive in their tasks.

A recent survey found that of all the areas that companies plan to make significant information technology investments in the next year, the top response was treasury (43%), followed by payments, cash reporting, and bank account management. This shows that treasury technology is on the forefront of the treasurer’s mind and spend plans. It is therefore a topic that must be well-understood and an investment that must be thoroughly evaluated.

The Current Landscape of Treasury Technology

There are many changes occurring in treasury technology. Vendors are expanding their offerings and capabilities to include more functionality. This increased functionality bleeds over into different sections of the treasury landscape. Treasury systems often include risk management tools geared for identifying exposures, data retrieval, and compliance-related tools such as those that help you file for FBAR. In the working capital and cash conversion arena there are many tools offered by your bank, from collections to the business process and data flows. Finally, a TMS can add treasury visibility. This is the ability to see where your cash is (what account, what part of the world) as well as other exposures such as counterparty risk, cash flow, etc.

Evaluation of the Current Landscape

A TMS handles many different aspects of cash management including: where cash is, how to move it, forecasting, and creating accounting entries off of the activities that originate internally or externally. A TMS used to be isolated in three sections (a cash-oriented system, a risk system, and an enterprise risk system), but as treasury has grown, functionality has become more modular and additions can be made as seen fit. Over time, more and more functionality can get added to the platform including managing your bank accounts, connecting to trading platforms, financial modeling, and hedge accounting.

Complexity Considerations

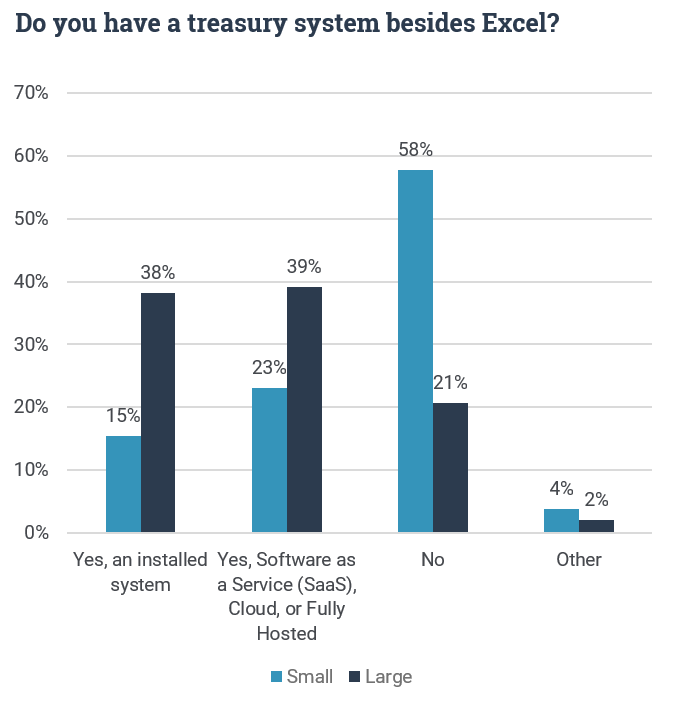

Often, we get asked what size organization warrants the investment in treasury technology. The simple answer is that the higher the revenue, the more likely a company will benefit from treasury technology. Though 58% of smaller companies are still using an excel spreadsheet, as organizations grow and expand, more automation is necessary. In fact, three-fourths of larger organizations are using a treasury system.

While a TMS is certainly the most common type of treasury solution utilized, there are a variety of other systems as well. Merger/acquisition activity can result in subsidiaries using a different TMS or treasury solution. Activities related to risk/hedge accounting analysis and FX trading, as well as bank connectivity, can often result in the use of additional systems. Often firms must juggle operations within these systems while also managing connectivity and integration with their firm’s ERP. Complexity within an organization can drive toward a TMS that is able to integrate different areas and systems in order to manage them in a more streamlined way.

In addition, there can be a wide range of payments for which treasury is responsible. The fact that treasury often handles the payments of subsidiaries and regional offices globally means that payment volumes can grow quite high. Over 50% of corporations have more than one hundred bank accounts, therefore keeping track of accounts can be problematic for complex organizations, another reason why treasury technology could be useful.

Even with the many benefits to treasury technology, one of the key challenges to beginning implementation is often the budget. Every organization has departments advocating for different uses of the budget. The size and revenue streams of any particular company will influence spend. Treasury needs to provide economic and strategic reasons for why treasury technology can benefit the entire organization and is therefore a worthy use of the organization’s budget.

A consideration when it comes to the budget is what kind of software an organization chooses to employ. On the one hand, spreadsheets are very low cost and changes can be made rapidly. On the other end of the spectrum there are global risk/commodity intensive systems that are much more complex with a much higher price tag. Thankfully, in recent years there have been a growing number of treasury systems situated between the lower end of spreadsheets and the higher end systems like commodity intensive systems that balance capabilities and costs. In treasury technology, capabilities continue to increase, use gets easier, and costs have started to become more manageable. This leads to the democratization of treasury as smaller organizations can afford better capabilities, making treasury management systems accessible for almost any size organization.

Building the Business Case

If the treasury team decides that a TMS could be a strong investment based on the size and scope of the organization, they must then build a strong business case to help prove the value of the investment and assist in getting the organization on board. Treasury does not sit in a silo but instead controls a lot of the organization’s cash flow. Therefore, there are many stakeholders with influence in this decision. Treasurers must involve other departments such as accounting, management, and IT to make the business case for this kind of investment.

What are some things to think about when building a business case? Consider each stakeholder and their needs. There is a part of the business case that is related to reducing errors in accounting. For upper level management, there is a need for data and visibility. Accounts Payable is looking to optimize working capital and achieve higher discounts. There are plenty of benefits in implementing a TMS for different departments, treasury must simply present them clearly.

A Brief Introduction to ROI

When utilizing ROI as part of the business case for a TMS, there are both quantitative and strategic considerations. Quantitative considerations include:

- System maintenance and hardware costs

- Connectivity and data transformation costs

- Data charges and data cleaning charges

- Staff time savings

- Capital usage and efficiency gains

- Reduced fees and charges for transactions

The strategic considerations are just as important, even though they cannot necessarily be quantified. These include risk management, scalability, visibility, control and security.

Implementation Considerations

It is not always easy to know what the challenges and risks in a TMS implementation will be. Even when we do our best to identify potential risks and challenges, the ability to effectively gauge just how much of a threat or hindrance each risk poses can be difficult.

Many treasurers have expected that sticking to the implementation roadmap would be the biggest challenge to a TMS implementation, but in reality the biggest challenge was effective communication with the vendor and support teams.

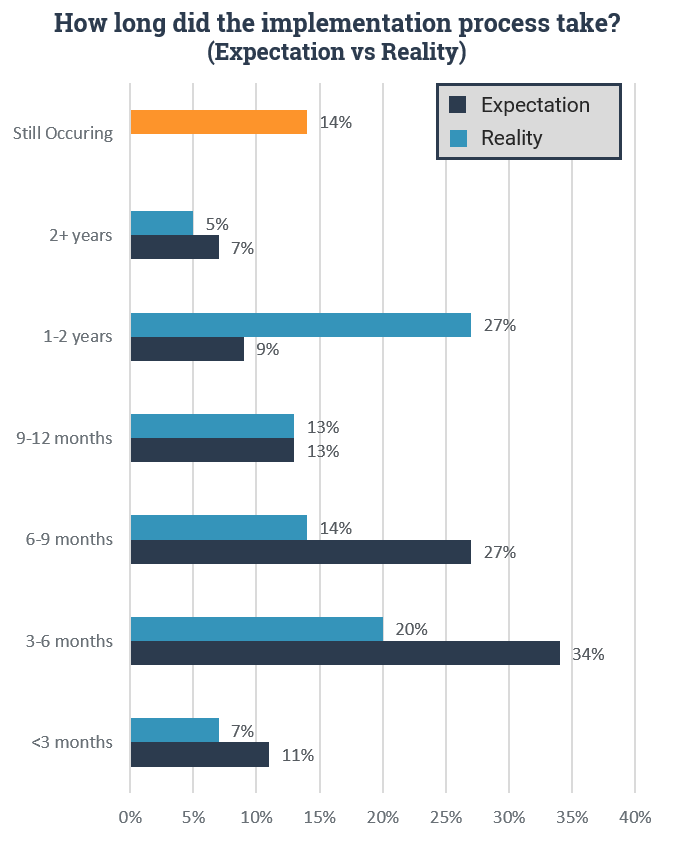

Collaboration is key, so as many influential parties as possible should be invited to the table. Internal and external stakeholders need to be involved and informed throughout this process. It is also important to not underestimate the time needed for a successful implementation. While 72% of organization expected their TMS implementation to be completed in nine or fewer months, the reality was that 52% of implementations took at least nine months or longer.

Also note that 60% of respondents from a recent survey indicated that they are currently using less than 80% of the TMS functionality they had purchased. Just because a TMS offers every functionality does not mean that every functionality is needed by your company. An organization that is implementing a TMS should be sure to only implement those functionalities that are absolutely necessary. The purchase of unnecessary functionality can tack on excessive cost.

Key Takeaways

When considering treasury technology, system capabilities need to align with organizational complexity. Internal buy-in from other departments will be required, so provide a clear business case with ROI as the basis for showing how a TMS can benefit each facet of the organization. Finally, take care with the implementation phase so that budget, time, and resource constraints are adequately managed. A TMS can be a wise solution for a treasury team that is understaffed and overworked.

To learn more about this, you can view a webinar replay on this topic here.

Meredith Carpenter

Content Copywriter, Treasury Analyst

Meredith Carpenter works as a content analyst and copywriter in the market intelligence division of Strategic Treasurer, a top tier treasury consultancy headquartered in Atlanta, Georgia.